Account receivable is a cornerstone in the realm of business finance. It is the linchpin for managing cash flow and processing invoices. This comprehensive guide aims to elucidate the intricacies of this pivotal financial concept.

Account receivable embodies the monetary obligations owed to a company for goods or services rendered on credit terms. It is a fundamental aspect of a thriving enterprise, influencing operational efficiency and long-term financial strategy.

Optimal management of account receivable is imperative for sustaining a consistent cash flow. Businesses employ diverse tactics to expedite payments, ranging from explicit credit policies to sophisticated automated invoice management systems.

The accounts receivable turnover ratio serves as a critical indicator. It quantifies the swiftness with which customers settle their dues. For example, Apple Inc. showcased a ratio of 13.2 in Q4 2021, reflecting a commendable pace in payment collection.

Key Takeaways

- Account receivable represents money owed to a business

- It’s crucial for cash flow management

- The accounts receivable turnover ratio measures payment speed

- Clear credit policies help in managing account receivables

- Automated systems can streamline invoice management

- Timely collection of receivables is vital for business liquidity

What Are Accounts Receivable and Their Importance

Accounts receivable (AR) are pivotal in the realm of business finance. They signify the monetary obligations owed to a company for goods or services rendered but unpaid. A comprehensive understanding of the accounts receivable definition is indispensable for appreciating its role in managing cash flow.

Definition and Basic Concepts

AR is classified as a current asset on a company’s balance sheet. It encompasses trade receivables, notes receivables, and other receivables such as interest or taxes owed. Generally, customers settle their invoices within a timeframe ranging from 30 days to 12 months, contingent upon the credit terms agreed upon.

Role in Business Finance

AR serves as a critical indicator of a company’s financial well-being. It mirrors the efficacy of credit and collection processes. The accounts receivable turnover ratio is a key metric, gauging how adeptly a business collects owed monies. This ratio is indispensable for evaluating the company’s overall financial performance.

Impact on Cash Flow Management

Effective management of AR is paramount for sustaining healthy cash flow. It diminishes the reliance on external financing and mitigates the risk of cash shortages. By streamlining AR processes, enterprises can bolster their cash reserves, support growth endeavors, and fulfill short-term obligations with greater ease.

| AR Metric | Description | Impact on Cash Flow |

|---|---|---|

| Days Sales Outstanding (DSO) | Average time customers take to pay | Lower DSO improves cash flow |

| Collection Effectiveness Index (CEI) | Efficiency of AR team in collecting payments | Higher CEI leads to better cash flow |

| Bad Debts to Sales Ratio | Percentage of revenue lost to uncollected debts | Lower ratio enhances cash flow stability |

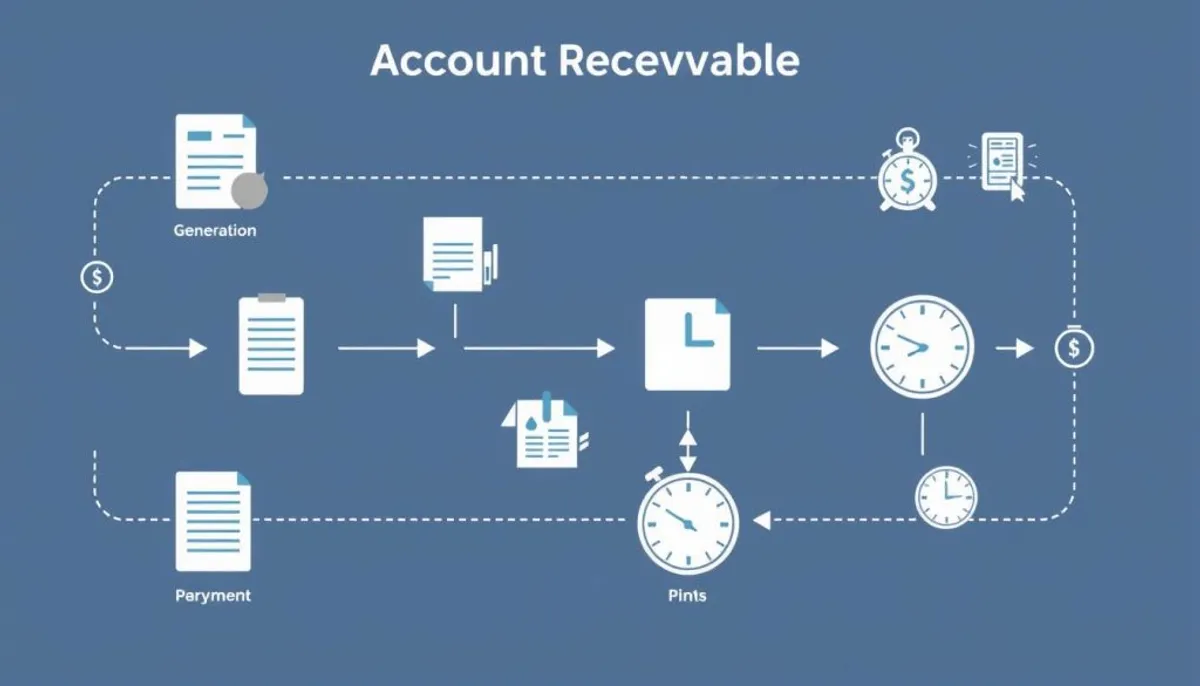

The Account Receivable Process Explained

The accounts receivable process is fundamental to business operations. It commences with a customer’s purchase and concludes with payment collection. We will dissect this process into its essential components.

Customer Onboarding and Contract Agreement

Before extending credit, businesses must assess a customer’s creditworthiness. This evaluation is critical in mitigating default risks. After approval, both parties agree on payment terms and sign a contract.

Invoice Generation and Processing

Invoice generation is a pivotal step in the accounts receivable process. Timely invoicing is crucial for efficient payment collection. It is advisable to dispatch invoices within 24 hours post-product shipment or service completion.

Automated invoicing systems can handle thousands of electronic invoices annually, minimizing errors and shortening billing cycles. Such automation can result in cost savings of up to 80% per invoice.

Payment Collection and Recording

The final phase involves payment collection and recording. Businesses frequently utilize aging reports to monitor unpaid bills. Offering diverse payment options can expedite payments and diminish overdue invoices. Upon receipt, payments are matched to outstanding invoices in a process called cash application.

Adopting an AR management solution can streamline this entire process, offering real-time cash flow visibility and reducing human errors. This efficiency can liberate capital for reinvestment in growth initiatives.

Essential Components of AR Management

AR management is a critical aspect of business finance, requiring attention to several key components. Effective AR strategies are vital for maintaining healthy cash flow and reducing financial risks. This ensures the financial stability of a business.

Establishing clear credit policies is a primary element of AR management. These guidelines determine how a company extends credit to customers. They set the foundation for smooth financial operations. Well-defined credit policies help minimize the risk of late payments and bad debts.

Efficient invoice processing is another vital component. Timely and accurate invoicing ensures customers receive bills promptly. This increases the likelihood of timely payments. Automated systems are often used to reduce errors and speed up the billing cycle.

Collections play a significant role in AR management. This involves following up on overdue payments and implementing reminder systems. It also involves developing strategies to encourage prompt payment. Effective collection practices can significantly improve a company’s cash flow and reduce the need for external financing.

Accurate record-keeping is essential for tracking customer payments and identifying trends. This component often relies on advanced software solutions that can integrate with other financial systems. It enables informed decision-making.

| AR Component | Impact on Business |

|---|---|

| Credit Policies | Reduces financial risks |

| Invoice Processing | Speeds up payment cycle |

| Collections | Improves cash flow |

| Record-Keeping | Enables informed decision-making |

By focusing on these essential components, businesses can optimize their AR management. This leads to improved financial stability and growth opportunities.

Key Metrics for Tracking AR Performance

Monitoring AR metrics is essential for maintaining your business’s financial stability. These metrics offer insights into cash flow and customer payment habits. We will examine three critical AR metrics: DSO, CEI, and AR turnover ratio.

Days Sales Outstanding (DSO)

DSO gauges the speed at which a company collects payments. It’s derived by dividing total accounts receivable by total credit sales, then multiplying by the period’s days. A lower DSO signifies faster payment collection. It’s advisable for DSO to be 50% or less of the payment terms.

Collection Effectiveness Index (CEI)

CEI assesses a company’s capability to collect funds from customers within a set timeframe. It’s computed using beginning and ending accounts receivable, along with monthly credit sales. A CEI above 80% is deemed satisfactory, indicating effective collection practices.

Accounts Receivable Turnover Ratio

The AR turnover ratio evaluates a company’s efficiency in managing credit and collecting payments. It’s determined by dividing net credit sales by average accounts receivable. A higher ratio signifies quicker invoice collection, which is beneficial for managing cash flow.

| Metric | Formula | Ideal Range |

|---|---|---|

| DSO | (AR ÷ Total Credit Sales) × 365 | <50% of payment terms |

| CEI | (Beginning AR + Credit Sales – Ending AR) ÷ (Beginning AR + Credit Sales – Ending Current AR) × 100 | >80% |

| AR Turnover Ratio | Net Credit Sales ÷ Average AR | Higher is better |

By tracking these AR metrics, businesses can enhance their cash flow management and overall financial performance. Regularly analyzing these metrics helps uncover trends and areas for improvement in the accounts receivable process.

Implementing Effective AR Strategies

Effective AR strategies are essential for maintaining a healthy cash flow and driving business growth. Establishing clear payment terms is a fundamental aspect of successful accounts receivable management. It ensures that customers are well-informed about their payment obligations, thus reducing confusion and payment delays.

Implementing early payment incentives can encourage customers to settle their invoices in a timely manner. For instance, offering a 2% discount for payments made within 10 days can substantially enhance cash flow. Utilizing automated reminders is another effective strategy, helping to minimize late payments and streamline the collection process.

Open and regular communication with customers is paramount. Keeping them informed about payment status and addressing their concerns promptly can expedite resolutions and strengthen customer relationships. Segmenting customers based on their payment behavior allows for more targeted approaches, ensuring the efficient allocation of resources.

| AR Strategy | Benefits | Implementation Tips |

|---|---|---|

| Clear Payment Terms | Reduced confusion, faster payments | Include terms on invoices, contracts |

| Early Payment Incentives | Improved cash flow | Offer small discounts for quick payments |

| Automated Reminders | Reduced late payments | Use AR software for timely notifications |

| Customer Communication | Better relationships, faster resolutions | Regular updates, prompt issue addressing |

Utilizing technology for process automation can greatly enhance AR efficiency. This enables teams to concentrate on strategic tasks while routine transactions are handled automatically. Regularly reviewing credit policies ensures they remain in line with business objectives and market conditions.

Understanding Credit Policies and Terms

Credit policies are crucial for managing accounts receivable. They guide businesses in evaluating customer creditworthiness, establishing payment terms, and managing credit risks. A well-crafted credit policy optimizes cash flow and mitigates liquidity issues.

Credit Assessment Methods

Evaluating customer creditworthiness involves examining financial stability and payment history. Companies employ various techniques to assess credit risk:

- Reviewing financial statements

- Checking credit reports

- Analyzing past payment behavior

- Evaluating industry trends

Setting Payment Terms

Payment terms must balance customer needs with company cash flow requirements. When setting terms, consider:

- Industry standards

- Customer relationship

- Credit risk level

- Company’s financial position

Managing Credit Risks

Effective credit risk management requires ongoing monitoring and proactive measures. Key strategies include:

- Regular review of customer accounts

- Implementing credit limits

- Developing collection strategies for overdue accounts

- Automating credit management processes

Implementing robust credit policies enables businesses to streamline accounts receivable, enhance cash flow, and reduce potential losses from bad debts.

The Role of Technology in AR Management

Technology has profoundly impacted accounts receivable (AR) management. AR automation and advanced accounting software have streamlined processes such as invoice generation, payment processing, and data analysis. These innovations significantly reduce manual tasks, minimizing errors and enhancing staff productivity.

Digital invoicing systems expedite the billing-to-payment cycle. E-payment solutions, including Stripe and PayPal, enhance cash flow efficiency. In the UK, small-medium enterprises are owed £61 billion in late payments, underscoring the necessity for efficient AR processes.

AI-driven features in AR software include:

- Payer ratings

- Late payment predictors

- Recommended chasing times

- Personalized payment reminders

These intelligent tools expedite payment receipt. Payment portals enable customers to pay directly from invoices, further accelerating collections.

Blockchain technology is poised to revolutionize AR management. It introduces secure, transparent ledgers for financial transactions. This innovation reduces manual processing and enhances transaction visibility.

Data analytics tools empower businesses to identify trends and refine their collection strategies. By integrating technology, companies can decrease delinquency rates and optimize cash flow management.

Best Practices for Collection Management

Effective collection management is essential for maintaining a healthy cash flow. Implementing smart strategies can enhance the accounts receivable process and diminish late payments.

Early Payment Incentives

Payment incentives can expedite collections and enhance cash flow. Research indicates that early payment discounts can hasten receivables collection. For instance, a 2% discount for payments within 10 days can encourage customers to pay promptly.

Follow-up Procedures

Establishing clear follow-up procedures is vital for successful collection management. Regular reminders for late invoices can prompt timely payments, thus improving cash flow. A digital filing system for signed agreements aids in managing accounts receivable and lessens non-payment risks.

Handling Late Payments

Late payment handling necessitates a balanced approach. Offering payment plans during financial hardships can preserve client relationships while ensuring full payment. For persistent late payers, consider implementing policies such as down payments or milestone payments to mitigate risks.

| Metric | Target | Impact |

|---|---|---|

| Days Sales Outstanding (DSO) | Below 30 days | Faster cash conversion |

| Collection Effectiveness Index (CEI) | Close to 100% | Improved collection rate |

| Accounts Receivable Turnover Ratio | High ratio | Efficient billing process |

By focusing on these collection management practices, businesses can significantly enhance their cash flow and financial health. Utilizing accounts receivable automation software can reduce time spent on cash collection by up to 80%, streamlining the entire process.

Introducing ti3: Modern AR Management Solution

In today’s fast-paced business world, managing accounts receivable poses a significant challenge. Ti3, a cutting-edge AR management solution, offers a streamlined approach to collection processes, enhancing cash flow. This innovative platform simplifies AR management, improving client relationships through its array of features.

Automated Payment Reminders

Ti3’s automated reminders address the issue of late payments effectively. With 87% of businesses facing delayed payments, this feature is a game-changer. It sends timely, personalized reminders to clients, reducing the need for manual follow-ups. This automation can lead to payments that are 4 times faster than traditional methods.

Streamlined Collection Process

The ti3 platform revolutionizes the collection process. By implementing electronic invoicing, businesses can reduce delays and cut costs by 60-80%. This efficiency is crucial, considering that 33% of SMEs wait over two months for overdue invoices. Ti3’s streamlined approach helps businesses maintain a healthy cash flow and reduce time spent on collections.

Client Relationship Preservation

While improving collections, ti3 also focuses on maintaining positive client relationships. The platform’s friendly payment reminders and clear communication tools help preserve business connections. This approach aligns with research showing that invoices with a “thank you” are settled 90% faster.

| Feature | Benefit | Impact |

|---|---|---|

| Automated Reminders | Faster Payments | 4x quicker payments |

| Electronic Invoicing | Cost Reduction | 60-80% cost savings |

| Friendly Communication | Improved Relationships | 90% faster settlements |

By adopting ti3, businesses can transform their AR management, reducing manual processing time by 80% and minimizing errors by 66%. This modern solution addresses the challenges of traditional AR management, providing a cost-effective and efficient alternative to outdated methods.

Common AR Challenges and Solutions

Accounts receivable (AR) teams encounter numerous hurdles in today’s business environment. Late payments are a major challenge, affecting cash flow and financial stability. To tackle this, companies employ strategies such as sending reminders before due dates and promptly contacting customers with overdue payments.

Customer payment management issues contribute to higher Days Sales Outstanding (DSO). Solutions include providing clear payment instructions, offering detailed invoices, and implementing user-friendly payment portals. These steps streamline the payment process, enhancing overall cash application efficiency.

Efficient time management is essential for AR operations. Simplifying processes, introducing safeguards against errors, and automating complex tasks optimizes resource allocation. This approach addresses the challenge of manual payment processing, which often causes delays and inefficiencies.

Data management is another obstacle as data volumes grow. Consolidating AR data into a single platform and using real-time dashboards for key performance indicators (KPIs) offers comprehensive insights. This strategy aids in dispute resolution and boosts AR performance.

| AR Challenge | Solution |

|---|---|

| Late payments | Pre-due date reminders, prompt follow-ups |

| High DSO | Clear payment instructions, itemized invoices |

| Manual processing | Process automation, error reduction safeguards |

| Data management | Consolidated platforms, real-time dashboards |

By tackling these common AR challenges with targeted solutions, businesses can greatly enhance their accounts receivable processes. This improvement leads to better cash flow and maintains strong customer relationships.

AR Reporting and Analytics

AR reporting is vital for financial planning and decision-making. It tracks key performance indicators (KPIs) to offer insights into accounts receivable processes and financial health. This enables businesses to make informed decisions.

Key Performance Indicators

KPIs measure AR management effectiveness. Essential metrics include:

- Days Sales Outstanding (DSO)

- Collection Effectiveness Index (CEI)

- Accounts Receivable Turnover Ratio

These KPIs reveal payment trends and collection efficiency. They help identify areas for AR process improvement.

Data-Driven Decision Making

AR reporting empowers companies to make informed decisions with real-time data. Analyzing customer payment behavior allows businesses to:

- Adjust credit policies

- Optimize collection strategies

- Forecast cash flow more accurately

Financial Planning Integration

Integrating AR analytics with financial planning enhances budgeting and resource allocation. This integration aids in:

- Predicting future cash flow

- Identifying potential risks

- Developing strategies to improve financial performance

By utilizing AR reporting and analytics, companies can optimize their financial operations. This leads to data-driven decisions that enhance their financial performance.

| AR Report | Purpose |

|---|---|

| Customer – Detail Trial Balance | Internal checks on customer ledgers |

| Customer – Summary Aging Simp. | Accounts receivable aging analysis |

| Aged Accounts Receivables | Analyze customer balances and debt collection reliability |

| Customer Statement | Provide payment reminders to customers |

Conclusion

Effective AR management is a cornerstone of financial health for businesses. It transcends mere payment collection, aiming at optimizing cash flow and driving growth. By adopting smart strategies and leveraging technology, companies can transform their AR processes into powerful success tools.

The significance of AR management is profound. It directly influences a company’s capacity to invest, expand, and navigate financial challenges. Metrics like the accounts receivable turnover ratio and days sales outstanding analysis offer critical insights into financial performance. These metrics enable companies to refine their credit policies and collection strategies.

In today’s fast-paced business environment, embracing technology is crucial for AR management success. Solutions like ti3 automate payment reminders, streamline collection processes, and preserve client relationships. By adopting such tools, businesses can reduce late payments, enhance cash flow, and allocate resources to strategic initiatives.

AR management is a multifaceted discipline requiring ongoing attention and refinement. By focusing on best practices, leveraging data-driven insights, and adapting to market changes, businesses can ensure their AR processes positively impact their bottom line and long-term success.

RelatedRelated articles