Welcome to our comprehensive guide on accounts receivable management. If you’re seeking to streamline your receivables collection process and enhance your company’s financial health, you’ve found the right resource. This guide will navigate you through the intricacies of the AR process, equipping you with the knowledge to manage your accounts receivable effectively.

Did you know that approximately 65% of businesses extend credit solely to other companies, not individual customers? Or that there’s a 3:1 preference for monthly billing over weekly? These statistics underscore the significance of a proficient accounts receivable system in today’s business environment.

We will cover all aspects, from establishing efficient credit policies to utilizing automation for superior outcomes. Whether you’re a small business owner employing manual AR systems (like 45% of small businesses) or a large corporation aiming to refine your processes, this guide caters to all.

Ready to embark on mastering the art of accounts receivable management and enhancing your company’s cash flow? Let’s begin our journey together!

Key Takeaways

- Accounts receivable are crucial for business cash flow and financial health

- 65% of businesses extend credit only to other companies

- Monthly billing is preferred 3:1 over weekly billing

- 45% of small businesses still use manual AR systems

- Effective AR management can significantly improve payment collection rates

- Automation tools can streamline the AR process and reduce costs

Understanding Accounts Receivable Fundamentals

Accounts receivable are integral to business operations. Let’s explore the core aspects of this financial concept.

Definition and Importance in Business Operations

The accounts receivable definition encompasses the monies owed to a company by its clientele for goods or services rendered on credit. This short-term credit line is indispensable for enterprises, significantly influencing cash flow and liquidity. Notably, delayed payments from customers are a primary cause of cash flow issues for businesses.

Role of AR in Financial Statements

In financial statements, AR is listed as a current asset on the balance sheet. It is regarded as a liquid asset and a component of a company’s working capital. Businesses estimate uncollectible accounts by establishing an “allowance for uncollectible accounts.” This typically involves assuming around 5% of accounts receivable will remain uncollected.

Difference Between Accounts Receivable and Accounts Payable

Grasping the distinction between accounts receivable and accounts payable is essential for sound financial management. Accounts receivable signifies monies owed to the company, whereas accounts payable represents monies owed by the company. This differentiation is critical for fostering healthy business relationships and adeptly managing cash flow.

| Aspect | Accounts Receivable | Accounts Payable |

|---|---|---|

| Definition | Money owed to the company | Money owed by the company |

| Balance Sheet Classification | Current Asset | Current Liability |

| Cash Flow Impact | Inflow when collected | Outflow when paid |

| Turnover Ratio Importance | Higher ratio indicates faster customer payments | Lower ratio indicates better cash management |

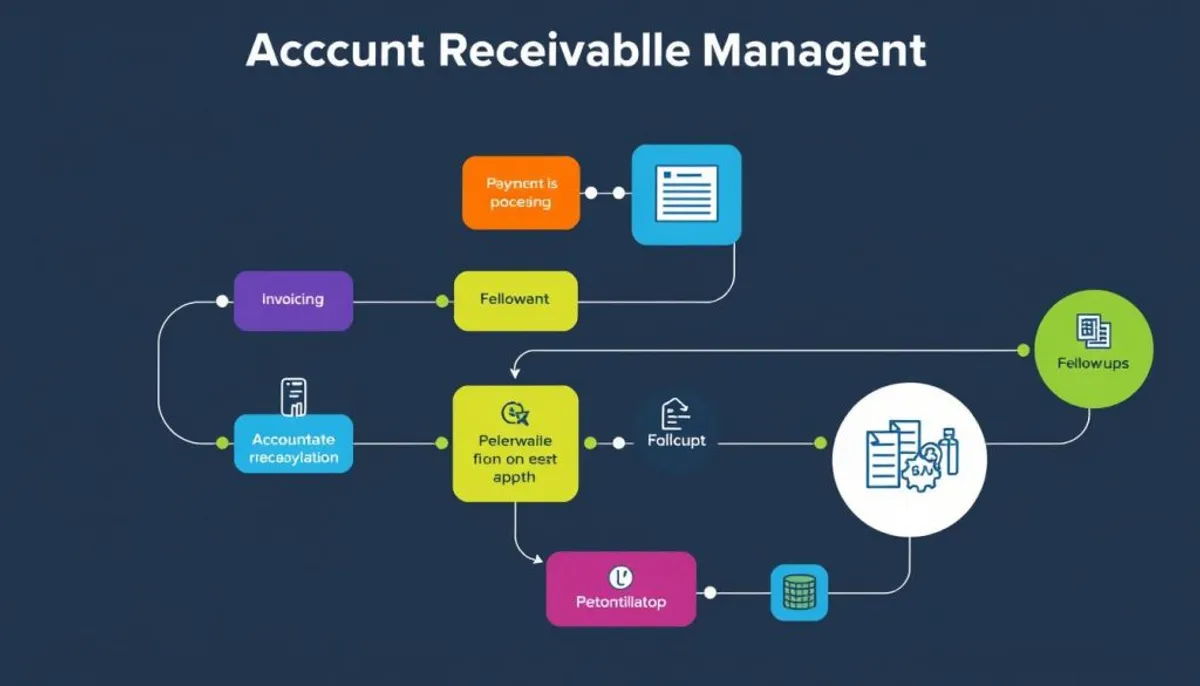

Collection of Accounts Receivable Process Steps

The AR collection process is vital for any business’s financial stability. A well-organized accounts receivable workflow ensures timely payments and fosters positive customer interactions. Let’s examine the essential steps in the receivables management process.

- Customer onboarding

- Invoice creation and delivery

- Tracking and collecting receivables

- Managing deductions and exceptions

- Cash reconciliation

Each phase in the AR collection process demands meticulous attention and efficient management. Adopting a structured methodology for these receivables management steps can notably enhance cash flow and diminish late payments.

| Step | Challenge | Solution |

|---|---|---|

| Invoice creation | 50% cite human error as cause of disputes | Automation software for accurate invoicing |

| Tracking receivables | Some industries have DSO above 50 days | Implement aging reports and follow-up procedures |

| Collecting payments | Multiple payment methods to manage | Offer diverse payment options (ACH, wire, cards) |

| Managing exceptions | 46% report issues with goods/services | Clear communication and dispute resolution process |

| Cash reconciliation | Manual processes prone to errors | Automated reconciliation tools |

By concentrating on these critical areas and utilizing technology, businesses can optimize their AR collection process. This optimization leads to enhanced financial performance. Remember, effective receivables management transcends mere money collection. It’s about cultivating robust customer relationships and securing enduring business success.

Establishing Effective Credit Policies

Creating robust credit policies is essential for managing accounts receivable. A well-crafted approach balances risk and customer satisfaction, supporting cash flow. Let’s explore the essential components of effective credit policy development.

Credit Application Process Development

A thorough credit application process forms the foundation of sound AR management. This step involves gathering crucial financial information from potential customers. By assessing their creditworthiness, businesses can make informed decisions about extending credit.

Setting Credit Limits and Terms

Credit limit setting is a critical aspect of AR risk assessment. It involves determining the maximum amount of credit to extend to each customer. Factors to consider include payment history, financial stability, and industry norms. Payment terms should be clearly defined, specifying due dates and any early payment incentives.

Risk Assessment Strategies

Implementing effective risk assessment strategies is crucial for minimizing potential losses. This involves analyzing financial data, industry trends, and economic indicators. Regular reviews of customer accounts help identify potential issues before they escalate.

| Credit Policy Component | Key Considerations | Best Practices |

|---|---|---|

| Credit Application | Financial information, references | Standardized form, thorough verification |

| Credit Limits | Payment history, financial stability | Regular reviews, industry-specific limits |

| Payment Terms | Industry norms, cash flow needs | Clear communication, early payment incentives |

| Risk Assessment | Financial data, market trends | Continuous monitoring, proactive adjustments |

By focusing on these key areas of credit policy development, businesses can create a solid framework for managing accounts receivable. This approach helps minimize risk while fostering positive customer relationships and maintaining healthy cash flow.

Invoice Management and Documentation

Effective invoice management is crucial for maintaining healthy accounts receivable. It involves creating professional invoices, timing their delivery, and implementing robust tracking systems. Let’s explore these key aspects of AR documentation.

Creating Professional Invoices

Professional invoices are the cornerstone of successful invoice management. They should include clear details like unique invoice numbers, itemized descriptions of goods or services, and payment terms. Accurate invoices foster trust and confidence in business relationships, reducing payment delays.

Invoice Timing and Delivery Methods

Timely invoice delivery is essential for prompt payments. Businesses can use various methods such as email, electronic data interchange (EDI), or traditional mail. The choice depends on client preferences and industry standards. Quick delivery often leads to faster payments, improving cash flow.

Recording and Tracking Systems

Implementing efficient invoice tracking systems is vital for AR documentation. These systems help maintain accurate records and facilitate follow-ups on outstanding payments. Many businesses use specialized AR management software to streamline this process, reducing manual tasks by a significant percentage.

| Benefits of AR Tracking Systems | Impact |

|---|---|

| Reduction in manual tasks | Up to 60% |

| Increase in compliance | 90% |

| Time saved in client requests | 2-3 hours per request |

| Error reduction | Up to 80% |

By focusing on these aspects of invoice management, businesses can significantly improve their AR processes, leading to better cash flow and stronger client relationships.

Streamlining Collections with ti3 Platform

The ti3 platform is transforming accounts receivable management. It is a cutting-edge AR automation tool designed to overcome common business hurdles. With 49% of US invoices overdue and 89% of SMBs facing growth obstacles due to late payments, the urgency for effective solutions is evident.

Automated Payment Reminders

The ti3 platform’s automated reminder system addresses a critical issue: 30% of unpaid bills require at least three reminders for settlement. By implementing timely, automated reminders, businesses can slash the 14 hours weekly on payment collection tasks by 65% for many companies.

Issue Escalation Features

With 20% of invoices unpaid for 60 days or more, the ti3 platform’s escalation features are invaluable. These tools efficiently handle overdue accounts, essential when considering that after 90 days, the likelihood of payment drops by 60%.

Client Relationship Management Tools

The ti3 platform seamlessly integrates client relationship management into AR processes. This integration is crucial, as it enables businesses to maintain positive relationships while enhancing collection rates. The platform’s CRM tools facilitate the balance between timely collections and customer satisfaction.

By utilizing the ti3 platform’s AR automation capabilities, businesses can significantly enhance their accounts receivable processes. This all-encompassing solution addresses the full range of AR challenges, from initial invoicing to final payment collection.

Managing Overdue Accounts

Effective management of overdue accounts is vital for maintaining a company’s financial health. Handling late payments can have a profound impact on a business’s stability. Thus, an efficient AR collections strategy is crucial for addressing delinquent accounts swiftly.

Utilizing a system to categorize overdue accounts is essential for prioritizing collection efforts. Many businesses employ a method based on the number of days past due:

- 30 days delinquent

- 60 days delinquent

- 90 days delinquent

- 120+ days delinquent

Streamlining dunning workflows and clearly communicating payment terms are fundamental to successful overdue accounts management. Sending reminders before due dates and offering diverse payment options can significantly reduce late payments.

Companies leveraging AR automation software are better positioned to tackle late payment issues. These tools enhance collection efforts by prioritizing tasks and eliminating the need for manual calls, thus boosting overall efficiency in AR collections strategy.

| Delinquency Period | Action |

|---|---|

| 30 days | Send friendly reminder |

| 60 days | Follow up with phone call |

| 90 days | Escalate to management |

| 120+ days | Consider third-party collection |

By adopting these strategies and fostering clear communication between AR and AP teams, businesses can efficiently manage overdue accounts. This approach enhances overall financial health.

Accounts Receivable Analytics and Metrics

AR analytics are vital for assessing the success of collection efforts. They enable businesses to understand their financial standing and refine their approaches. By examining key metrics, companies can uncover valuable insights, leading to better financial health.

Days Sales Outstanding (DSO)

The DSO calculation is a cornerstone in AR analytics. It quantifies the time elapsed before payments from customers are received. A reduced DSO signifies quicker payment processing and enhanced liquidity. It is advisable for DSO to remain below the payment term by no more than 50%.

Collection Effectiveness Index (CEI)

The CEI evaluates the success of collection endeavors. It gauges the proportion of receivables collected within a given timeframe. A CEI exceeding 80% is deemed satisfactory, with higher figures indicating superior management.

Receivables Aging Reports

Receivables aging analysis is pivotal for streamlining collection strategies. These reports segment outstanding invoices by due date. This aids in pinpointing accounts at risk, facilitating prompt action.

| Aging Bucket | Risk Level | Collection Priority |

|---|---|---|

| 0-30 days | Low | Normal follow-up |

| 31-60 days | Moderate | Increased attention |

| 61-90 days | High | Urgent action required |

| 90+ days | Very High | Immediate escalation |

Utilizing these AR analytics and metrics empowers businesses to discern patterns, predict cash flow, and execute strategic decisions. This leads to enhanced collection strategies and overall financial performance.

Legal Considerations and Compliance

Understanding AR legal issues is paramount for businesses. Debt collection laws are fundamental to accounts receivable compliance. The Fair Credit Billing Act mandates that customers report billing errors within 60 days. Businesses must swiftly act to collect, lest they risk losing up to $50 per transaction.

The Fair Credit Reporting Act stipulates that information suppliers must report accurately. They must update incorrect data expeditiously and inform customers of negative reports. The Equal Credit Opportunity Act bars discrimination in credit applications based on race, sex, or age.

Law firms encounter unique challenges with accounts receivable. Many have balances aged over 120 days, affecting their financial health. Third-party collections typically charge 30% of the collection fee. This method is often chosen for accounts aged over 120 or 180 days.

| Aspect | Recommendation | Impact |

|---|---|---|

| Collection Rate | 95% or higher | Improved financial health |

| Invoicing | Timely and regular | Increased prompt payments |

| Client Communication | Open and frequent | Better payment rates, fewer complaints |

| Payment Methods | Online and scheduled options | Streamlined process, reduced delays |

It is crucial to maintain detailed legal knowledge and compliance. This preserves a good reputation, avoids fines, and prevents customer lawsuits. Regular updates on changing laws ensure ongoing compliance and protect businesses from AR-related legal issues.

Best Practices for AR Management

Effective accounts receivable (AR) management is vital for maintaining a healthy cash flow. Let’s examine some AR best practices that can refine your collection process and elevate your financial performance.

Early Payment Incentives

Offering early payment discounts can incentivize customers to pay their bills on time. A small percentage off for payments within a certain timeframe can enhance your cash flow and diminish the risk of late payments.

Customer Communication Strategies

Clear and consistent communication is essential for successful AR management. Regular updates, personalized outreach, and swift issue resolution can cultivate positive customer relationships. This strategy can expedite payments and diminish disputes.

Digital Payment Integration

Adopting digital payment solutions simplifies the collection process. Online portals, mobile payment options, and automated billing systems facilitate easier payments and transaction tracking. This integration can notably reduce processing times and errors.

Implementing these AR best practices can yield significant benefits. For example, agencies using collection services must establish written contracts and wait at least 30 days after notifying debtors before assigning debts. Also, businesses actively tracking failed payments can lose 37% less revenue to bad debt and collect 43% more from these transactions.

Remember, a seamless payment experience is paramount. A survey revealed that 83% of respondents prioritize easy payment processes when selecting online suppliers. By adhering to these best practices, you can enhance your AR management, improve customer satisfaction, and boost your financial health.

Conclusion

Effective accounts receivable management is essential for business success. In the U.S., 50% of B2B invoices are paid late, with an average DSO of 49 days. Thus, AR process improvement is critical. Companies can enhance their receivables management through smart strategies and technology.

Optimizing accounts receivable begins with clear policies and efficient invoicing. Offering various payment options and automating reminders can significantly improve timely collections. Tools like QuickBooks or FreshBooks can streamline processes, saving time and resources. In fact, 91% of CFOs in wholesale and manufacturing industries reported efficiency gains from digitizing payments.

To boost AR performance, businesses should focus on data analysis, flexible payment plans, and superior customer service. By refining their approach and using advanced analytics, companies can reduce late payments and bad debt. Remember, a well-managed accounts receivable process is vital for maintaining healthy cash flow and supporting long-term growth.

RelatedRelated articles