The challenges of running a small business are compounded by the need to pursue unpaid invoices. Collection agencies serve as a vital lifeline, offering solutions to the complexities of accounts receivable management. They leverage their expertise in commercial debt collection to expedite payment, all while preserving customer relationships.

IC System, a stalwart since 1938, exemplifies the art of ethical debt recovery. They provide tailored solutions that align with your business’s specific needs. Their use of online tools and automated processes enhances efficiency, contributing positively to your financial health without alienating customers.

Since 2004, American Profit Recovery has been dedicated to serving small businesses. Renowned for their respectful treatment of debtors, they frequently receive consumer accolades. Their 24/7 online portal empowers you to manage your debt collection endeavors effectively.

Empire Credit and Collection stands out with an 82% success rate on small business debts. Notably, there’s a 94% chance of payment within the first month. These agencies strive to justify their fees, typically around 35% of the recovered amount.

Key Takeaways

- Collection agencies specialize in debt recovery services for small businesses

- They offer customizable approaches to maintain customer relationships

- Online tools and automated processes improve efficiency

- Success rates can be as high as 82% for small business debts

- Agencies often charge around 35% of recovered funds

- Ethical practices and respectful communication are prioritized

- 24/7 online portals give businesses control over debt collection efforts

Understanding Professional Debt Recovery Services

Professional debt recovery services are essential for businesses to maintain financial stability. They specialize in delinquent account recovery, aiding in the management of unpaid invoices and enhancing cash flow. Exploring the core aspects of business-to-business collections reveals their significant benefits for your organization.

What Are Business Collection Services

Business collection services are tailored solutions for recovering outstanding debts from other businesses. These services employ expert strategies to secure payments, all while preserving valuable client relationships. Third-party debt collectors serve as an extension of your company, offering customized approaches to debt recovery.

The Role of Third-Party Collectors

Third-party debt collectors are professionals dedicated to recovering unpaid debts. They leverage their expertise to contact delinquent accounts, negotiate payment terms, and ensure compliance with legal regulations. These collectors typically charge a percentage of the recovered amount, often ranging from 25% to 50%.

Benefits of Professional Debt Recovery

Engaging professional debt recovery services offers numerous advantages for businesses:

- Higher recovery rates compared to internal efforts

- Time and resource savings

- Expert knowledge of debt collection laws and regulations

- Preservation of customer relationships

- Improved cash flow management

| Service | Description | Benefit |

|---|---|---|

| First-party recovery | Collectors act in your company’s name | Maintains brand consistency |

| Third-party collection | Traditional debt recovery process | Leverages specialized expertise |

| Accelerated recovery | Quick recovery of outstanding debts | Improves cash flow rapidly |

| Account billing services | Manages invoicing and billing | Streamlines financial processes |

By utilizing professional debt recovery services, businesses can focus on core activities while ensuring effective management of delinquent accounts. This approach not only improves financial health but also maintains positive relationships with clients.

Collection Agencies for Small Businesses: A Comprehensive Guide

Small business credit control is essential for maintaining a healthy cash flow. When invoices remain unpaid, the need for professional debt recovery services becomes critical. This guide delves into collection agencies designed for small businesses, highlighting their services and benefits.

Collection agencies are well-versed in the unique challenges faced by smaller enterprises. They offer tailored solutions for various industries, including tech startups and local shops. These services address specific issues related to receivables and invoice payment terms.

When choosing a collection agency, it’s important to consider several factors. These include industry specialization, fee structures, and success rates. Here are some key statistics to consider:

| Agency | Recovery Rate | Fee Structure |

|---|---|---|

| Summit Account Resolution | 34.8% | 7% – 50% |

| Prestige Services Inc. | 38% | 22% – 33% |

| Rocket Receivables | 4x industry average | $14.95 – $21.95 per account |

| IC System | Not specified | 25% or $14.95 per account |

Small businesses often turn to collection agencies when debts are 90 to 120 days past due. Effective strategies include crafting concise agreements, implementing late payment clauses, and aligning jurisdictions for efficient debt recovery processes.

By partnering with the right collection agency, small businesses can enhance their cash flow management. This allows them to focus on growth rather than being bogged down by unpaid invoices.

How ti3 Platform Revolutionizes Debt Collection

The ti3 platform is transforming debt collection for small businesses. It offers a fresh approach to managing overdue accounts, addressing common pain points in the collection process.

Automated Payment Reminders

Ti3’s automated reminders tackle late payments head-on. With 49% of US business invoices becoming overdue, this feature is a game-changer. It reduces the need for manual follow-ups, saving time and improving cash flow.

Streamlined Collection Process

The platform’s streamlined collection process cuts invoice processing time by 80%. This efficiency is crucial, considering 65% of businesses spend 14 hours weekly on payment collection tasks. Ti3 automates these processes, freeing up valuable time for core business activities.

Maintaining Client Relationships

Ti3 helps preserve client relationships during debt collection. With 89% of SMBs reporting that late payments hinder growth, maintaining positive relationships while ensuring timely payments is vital. The platform’s professional communication tools strike the right balance between firmness and courtesy.

| Manual Processing | Ti3 Platform |

|---|---|

| 30+ days average payment time | 14 days average payment time |

| $12 per invoice processing cost | 60-80% cost reduction |

| 1% error rate per 1,000 invoices | 66% reduction in errors |

By leveraging ti3’s SaaS platform, businesses can significantly improve their debt collection outcomes. The combination of automated reminders and a streamlined collection process not only speeds up payments but also helps maintain valuable client relationships.

When to Seek Professional Collection Services

Recognizing the need for professional debt recovery can significantly impact a small business’s financial health. It’s crucial to identify the indicators that signal the necessity for assistance with overdue accounts.

Signs You Need Collection Help

When all avenues of communication with customers have been exhausted, and still, no payment is forthcoming, it’s time to engage professional services. Be vigilant for these warning signs in payment behavior:

- Customers ignore your calls and emails

- They keep breaking payment promises

- You spot a pattern of late payments

Optimal Timing for Debt Recovery

Timing is everything when it comes to debt recovery. The ideal moment to initiate collection efforts is within 90 to 120 days of an account becoming overdue. Beyond three months, the likelihood of recovering the debt diminishes substantially.

Red Flags in Payment Behavior

Be cautious of these indicators:

- New customers who don’t respond to your first collection attempts

- Clients who always have excuses for late payments

- Those with a history of financial troubles

It’s worth noting that a collection letter can often prompt debtors to settle their accounts. Collaborating with a collection agency can notably enhance your financial performance over time. Don’t let overdue accounts erode your business’s liquidity – take swift action to safeguard your cash flow.

Cost Structure and Pricing Models

Collection agencies present various pricing models to cater to diverse business requirements. These include contingency-based pricing, flat-rate plans, and tiered services. Each model offers distinct advantages and considerations for small enterprises in need of debt recovery solutions.

Contingency-based pricing is a favored option among collection agencies. This model, often referred to as “no results, no charge,” requires payment only upon successful debt recovery. The rates vary, typically between 7% and 50% of the collected amount, influenced by the case’s complexity.

Flat-rate plans are ideal for businesses dealing with substantial debt volumes. Agencies offer these plans starting at $14.95 per account for debts that are easier to collect. This model aids in budgeting collection expenses more effectively.

Tiered services represent a flexible approach, blending elements of both contingency and flat-rate models. This structure features different service intensity levels, with pricing adjusted to reflect the level of service. It is beneficial for businesses with varied debt profiles.

| Pricing Model | Key Feature | Best For |

|---|---|---|

| Contingency-based | Pay only when debt is collected | Businesses with limited cash flow |

| Flat-rate | Fixed fee per account | Companies with high-volume, low-value debts |

| Tiered services | Flexible pricing based on service level | Businesses with diverse debt portfolios |

In selecting a pricing model, consider the age and complexity of your debts, as well as your business’s financial situation. The appropriate model can profoundly influence your debt recovery success and overall financial well-being.

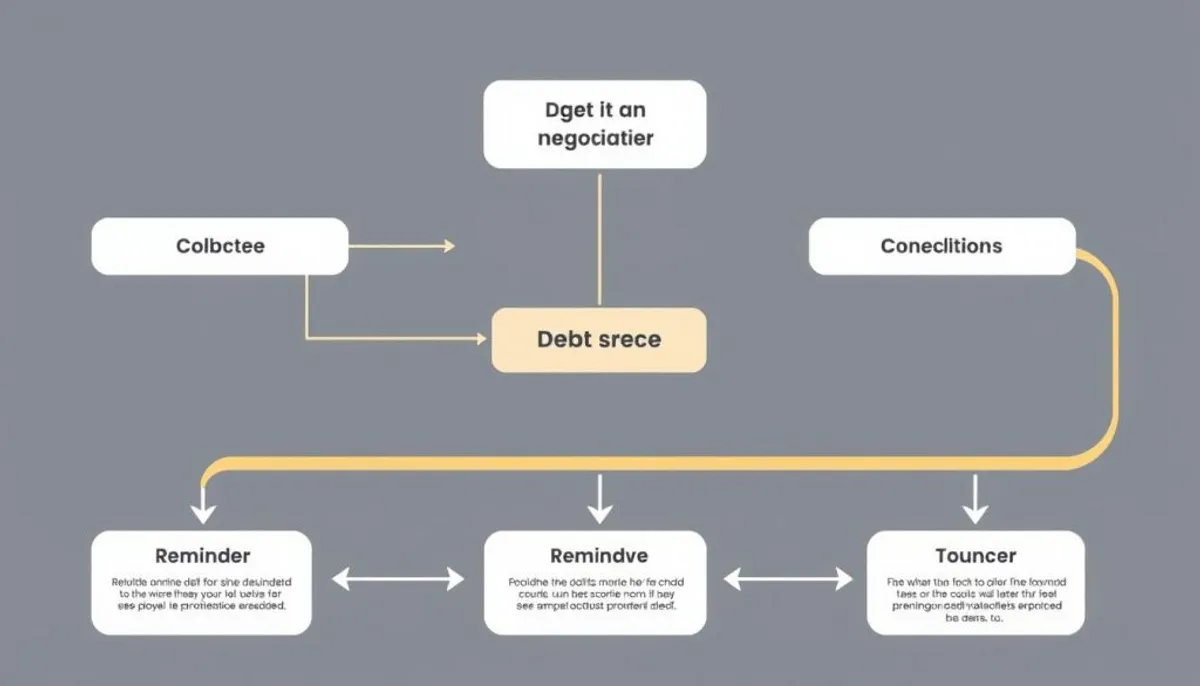

The Debt Collection Process Explained

The debt collection process is vital for small businesses to reclaim unpaid funds. Grasping this process aids in overcoming the hurdles of obtaining payment from delinquent accounts.

Initial Contact and Communication

The debt collection journey commences when a payment is 30 days overdue. At this juncture, collection agencies dispatch formal letters and initiate phone calls to debtors. Emails and text messages are also employed to enhance communication. It’s crucial to acknowledge that accounts in collections can negatively affect credit scores for up to seven years.

Negotiation Strategies

Effective negotiation tactics are paramount for successful debt recovery. Collection agencies collaborate with debtors to devise payment plans or settlements. They might propose discounts for upfront payments or extend payment terms. These agencies typically acquire debt balances for approximately 30-35% of the original amount, affording them the flexibility to negotiate.

Legal Options and Enforcement

Should initial contact and negotiations prove unsuccessful, legal action becomes a viable option. This entails forwarding the account to a local attorney for litigation. The statute of limitations for debt collection lawsuits varies, spanning from 3 to 15 years. It’s noteworthy that debt settlement companies might counsel clients to halt payments, potentially triggering additional collection actions.

| Collection Stage | Typical Timeline | Actions Taken |

|---|---|---|

| Initial Contact | 30 days past due | Formal letters, phone calls |

| Aggressive Collection | 60 days past due | Increased contact, negotiation attempts |

| Charge-off Status | 90-180 days past due | Debt may be sold to collection agency |

| Legal Action | Varies | Potential court summons |

Maximizing Debt Recovery Success Rates

Debt recovery rates differ significantly across various sectors. Some agencies achieve success rates up to 80% in certain scenarios, yet the overall industry average remains around 20-25%. To elevate your debt recovery success, adopting effective strategies is imperative.

Swift action and consistent communication are fundamental to successful debt recovery. Prompt intervention can avert overdue accounts from escalating. Collaborating with a reputable collection agency for small businesses can notably augment your efforts, notably in intricate cases.

Utilizing technology enhances the debt collection process. Automated notifications, data analytics, and advanced call center tools can elevate efficiency and recovery rates. Training staff in effective communication is also crucial for successful debt recovery.

| Strategy | Impact on Debt Recovery Rates |

|---|---|

| Early Intervention | Prevents overdue accounts, maintains steady cash flow |

| Technology Integration | Streamlines processes, improves efficiency |

| Staff Training | Enhances communication, increases success rates |

| Partnering with Collection Agencies | Provides expertise, improves complex case resolution |

It’s essential to strike a balance between debt collection and customer retention strategies. By integrating these strategies, you can optimize your debt recovery rates while preserving valuable customer relationships.

Protecting Your Business Reputation During Collections

Maintaining a positive business image while recovering debts is crucial. Ethical debt collection practices help preserve customer relationships and protect your brand. Let’s explore how to balance effective debt recovery with professional communication.

Ethical Collection Practices

Ethical debt collection involves treating debtors with respect and dignity. This approach not only aids in debt recovery but also safeguards your business reputation. Many collection agencies emphasize fair practices, ensuring compliance with legal standards and maintaining professional conduct throughout the process.

Customer Relationship Management

Effective customer relationship management is key during debt collection. By focusing on open communication and understanding, businesses can maintain positive connections with clients even in challenging financial situations. This approach often leads to better outcomes and potential future transactions.

Professional Communication Standards

Upholding high standards of professional communication is essential in debt collection. Clear, respectful, and consistent messaging helps maintain transparency and builds trust. Here’s a breakdown of effective communication practices:

| Communication Practice | Benefits |

|---|---|

| Clear expectations | Reduces misunderstandings |

| Respectful language | Maintains positive relationships |

| Detailed record-keeping | Ensures transparency and accountability |

| Timely responses | Builds trust and credibility |

By implementing these ethical debt collection strategies, businesses can recover funds while preserving their reputation and customer relationships. Professional communication and fair practices are key to successful debt recovery without compromising your brand image.

Technology and Modern Collection Methods

The debt collection industry is undergoing a transformative shift, driven by advanced technology. Small enterprises now have access to sophisticated online debt collection tools. These tools are designed to enhance efficiency and elevate success rates through their array of features.

Digital communication has revolutionized interactions between collection agencies and debtors. Email campaigns, text messages, and bespoke online portals serve as multiple avenues for engagement. This multi-faceted approach has notably increased debtor response rates and expedited the collection process.

Artificial Intelligence (AI) and Machine Learning (ML) are pivotal in the debt recovery domain. These technologies scrutinize extensive data sets to forecast payment behaviors and devise tailored recovery strategies. By harnessing AI-driven insights, collection agencies can refine their tactics, benefiting their small business clientele.

Online payment portals have streamlined the repayment process for debtors. These platforms, known for their ease of use and security, facilitate swift and secure transactions. This, in turn, boosts cash flow for businesses. Automated payment reminders further ensure debtors remain on schedule, minimizing the necessity for manual interventions.

In the digital era, data security is paramount in debt collection. Esteemed agencies prioritize robust security measures to safeguard sensitive information. This dedication to data protection not only secures businesses and debtors but also fosters trust in the collection process.

Legal Compliance and Regulations

Collection agencies face a complex legal landscape to ensure fair practices. The Fair Debt Collection Practices Act (FDCPA) serves as the cornerstone for ethical debt recovery. It dictates how collectors can interact with debtors and prohibits abusive methods.

Fair Debt Collection Practices Act

The FDCPA mandates strict guidelines for debt collectors. It prohibits harassment, false threats, and overcharging. Collectors are barred from disclosing debt information to third parties or publishing names on blacklists. These measures safeguard consumers while allowing for fair collection practices.

State-Specific Requirements

State regulations further complicate legal compliance. Many states demand licenses for debt collectors to operate. Some states have stricter rules than the FDCPA. For instance, direct phone contact is often required before formal collection efforts start. This allows debtors to address issues promptly.

Documentation Requirements

Accurate record-keeping is essential for legal adherence. Collectors must document all communications and agreements meticulously. Such records are vital for legal defense and proving compliance with regulations.

| Requirement | Description |

|---|---|

| Communication Limits | Restrictions on time, place, and frequency of contact |

| Disclosure Rules | Mandatory information to provide during initial contact |

| Dispute Resolution | 60 days for customers to report billing issues, 90 days for resolution |

Legal compliance in debt collection is vital for both businesses and consumers. By adhering to the Fair Debt Collection Practices Act, state regulations, and maintaining accurate records, collection agencies can operate ethically and efficiently.

Conclusion

Small business debt collection is crucial for maintaining financial stability and growth. Professional debt recovery services act as a lifeline for businesses facing unpaid invoices and cash flow issues. These agencies significantly enhance recovery rates, often operating on a contingency basis that aligns their interests with small business owners.

Utilizing collection agencies can expedite the debt recovery process, ensuring businesses get paid faster. This efficiency is vital for small businesses operating on tight margins. By outsourcing debt collection, companies can concentrate on their core activities while experts handle the complexities of recovering outstanding payments.

The benefits of professional debt recovery extend beyond financial gains. Collection agencies employ advanced tools and customized strategies tailored to specific business needs. Their expertise in negotiation and extensive networks can lead to better results, notably for hard-to-collect accounts. By partnering with reputable agencies, small businesses can protect their reputation and maintain valuable customer relationships while effectively managing overdue accounts.

In conclusion, small business debt collection through professional services offers a cost-effective solution to a common challenge. By carefully selecting a collection agency that aligns with business values and employs ethical practices, small businesses can improve their financial health and focus on growth opportunities.

RelatedRelated articles