Understanding business finance can be complex. Accounts receivable is a fundamental concept you’ll encounter. This guide will elucidate the definition, process, and management of accounts receivable. We will examine real-world examples and best practices to enhance your comprehension of this critical business operation aspect.

Accounts receivable signifies the amount of money owed to a company for goods or services provided on credit. It is a pivotal component of a business’s financial health, influencing cash flow and stability. Grasping the accounts receivable process is crucial for maintaining a robust financial standing.

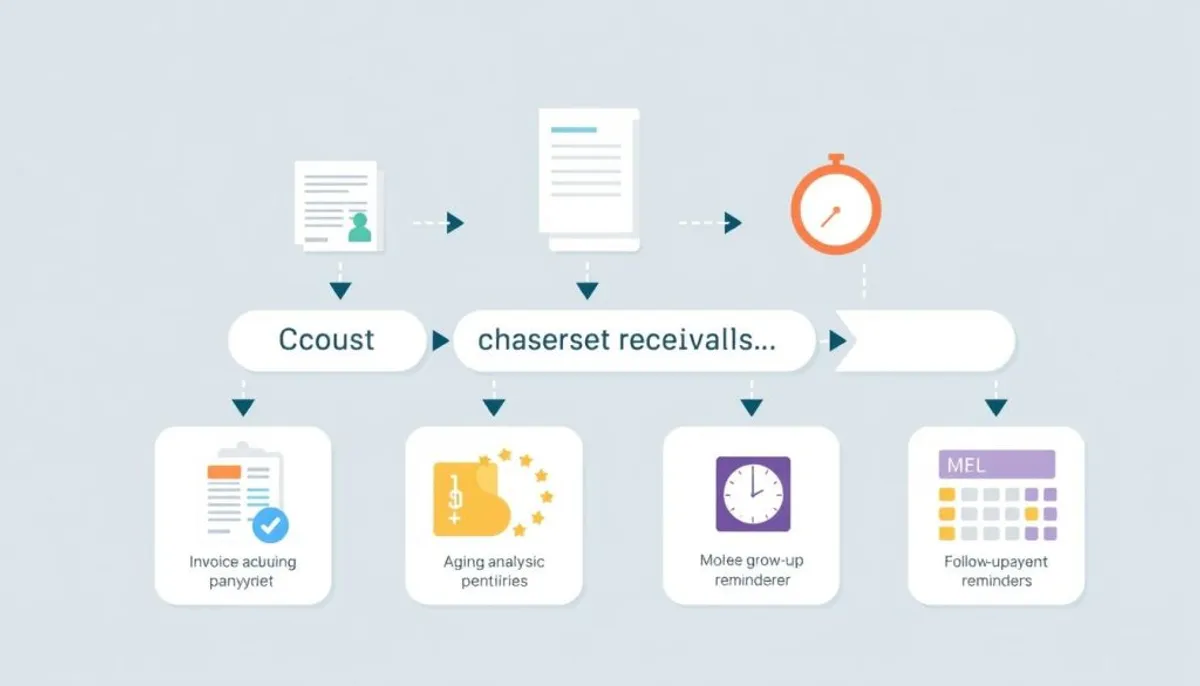

Effective accounts receivable management encompasses several stages, from customer onboarding to cash application. It necessitates clear policies, timely invoicing, and efficient follow-up procedures. By excelling in these areas, businesses can enhance financial forecasting and reduce risks.

Key Takeaways

- Accounts receivable are funds owed to a business for credit sales

- AR is listed as a current asset on the balance sheet

- The AR process includes invoicing, payment tracking, and cash application

- Effective AR management is crucial for maintaining healthy cash flow

- Key metrics like DSO and turnover ratio help assess AR performance

- Clear policies and automated systems can improve AR management

Understanding the Fundamentals of Accounts Receivable

Accounts receivable are pivotal in business finance, directly influencing cash flow and overall financial health. We will explore the foundational aspects of this critical concept, delving into its essential components.

What Are Accounts Receivable?

Accounts receivable denote funds owed to a business for goods or services rendered but unpaid. They are listed as a current asset on financial statements, indicating expected collection within a year. This mechanism enables businesses to extend credit to customers, enhancing sales while managing cash flow effectively.

The Role of AR in Business Finance

AR profoundly impacts a company’s financial health. It influences working capital, liquidity, and financial forecasting. The accounts receivable turnover ratio, computed as net credit sales divided by average AR, gauges payment efficiency. A higher ratio signifies quicker collections, whereas a lower ratio may indicate delayed payments or extended credit terms.

Key Components of AR Management

Effective AR management encompasses several critical elements:

- Credit policies: Setting clear payment terms (e.g., Net 30, 60, or 90)

- Invoicing: Promptly issuing accurate bills to customers

- Collections: Developing strategies for timely payments

- Cash application: Accurately recording received payments

By mastering these accounts receivable best practices, businesses can enhance their financial health and foster robust customer relationships. Grasping and applying effective AR processes is vital for entities of all sizes, from solo freelancers to large corporations with dedicated AR departments.

Examples of Accounts Receivable

Accounts receivable examples illustrate the diverse forms of money owed to businesses for goods or services rendered. These transactions are critical to a company’s financial well-being. Let’s examine some prevalent types of accounts receivable and their implications on a company’s financial health.

Credit Sales to Customers

Credit sales are a substantial component of accounts receivable. When a business extends credit for goods or services, it records an accounts receivable entry. For example, a clothing manufacturer might supply products to a retailer with a 30-day payment due date. This transaction is then part of the manufacturer’s accounts receivable.

Rental Income Receivables

Landlords frequently manage rental income receivables. For instance, if a landlord receives $3,000 in rent each month, it is recorded as accounts receivable. This type of receivable significantly influences the landlord’s cash flow and financial planning.

Service Fee Receivables

Service-based businesses often encounter service fee receivables. An electricity provider, for example, delivers service throughout the month but receives payment the following month. This delay results in an accounts receivable entry on their balance sheet.

Licensing Fee Receivables

Companies that license intellectual property frequently have licensing fee receivables. These fees, due at specific intervals, represent compensation for the use of patents, trademarks, or other intellectual property.

| Type of Receivable | Example | Typical Payment Terms |

|---|---|---|

| Credit Sales | Sony sells TVs worth $10,000 to Walmart | 30 days |

| Rental Income | Monthly rent of $3,000 | End of each month |

| Service Fees | Electricity provider’s monthly bill | Following month |

| Licensing Fees | Use of patented technology | Quarterly or annually |

Grasping these accounts receivable types is essential for effective cash flow management. Monitoring the accounts receivable turnover ratio and days sales outstanding is critical. It ensures efficient collection processes and maintains financial health.

The Complete Accounts Receivable Process Flow

The accounts receivable process is fundamental to a business’s financial health. It encompasses several stages aimed at efficient invoice management and prompt payment collection. Let’s dissect the essential phases of this AR workflow.

The journey begins with customer onboarding and credit approval. This initial step is crucial for evaluating new clients’ creditworthiness and establishing payment terms. Post-approval, the process advances to invoice generation and posting, initiating the payment cycle.

Next, collections management takes center stage. This phase involves sending reminders and engaging with customers to ensure payments are made on time. The workflow then transitions to payment receipt and processing, where incoming funds are documented and applied to the correct invoices.

Cash application is a pivotal part of the accounts receivable process. It ensures payments are correctly matched to invoices. Dispute management is also critical, addressing any payment discrepancies or issues.

For late payments, the AR workflow includes a dunning process. This entails escalating reminders to customers who have missed payment deadlines. Lastly, reporting and analysis are vital for tracking AR performance and guiding business decisions.

| AR Process Stage | Typical Timeline | Key Action |

|---|---|---|

| Invoice Generation | Day 0 | Create and send invoice |

| First Reminder | 7 days past due | Send friendly reminder |

| Second Contact | 14 days past due | Follow-up communication |

| Dunning Letter | 30 days past due | Issue formal notice |

| Final Notice | 45 days past due | Send final payment request |

Implementing an efficient accounts receivable process can significantly boost cash flow and reduce payment delays. It also fosters healthy customer relationships. Automating certain AR workflow components can further refine efficiency and accuracy in managing invoices.

Essential Metrics for AR Management

Monitoring accounts receivable metrics is vital for sustaining a robust cash flow. AR performance indicators are essential for evaluating a company’s financial standing and pinpointing areas for enhancement. Let’s examine pivotal metrics that can refine your AR management.

Days Sales Outstanding (DSO)

DSO gauges the average duration to collect payments. It is computed using the following formula:

DSO = (Accounts Receivables) / (Gross revenues) * (Number of days in period)

For instance, with $600,000 in annual turnover and $100,000 in unpaid invoices, DSO = ($100,000 / $600,000) * 365 = 61 days. It is advisable to maintain a DSO no more than 50% above your payment terms.

Collections Effectiveness Index (CEI)

CEI assesses collection efficacy as a percentage. An ideal score is above 80%. Here’s an illustrative example:

- Initial receivables: $100,000

- Monthly credit sales: $40,000

- Current month payments: $20,000

- Outstanding receivables payments: $60,000

- Resulting CEI: 67%

Accounts Receivable Turnover Ratio

This ratio reflects the swiftness of receivables conversion to cash. For example, with $100,000 in net sales and $10,000 in average accounts receivable, the A/R turnover ratio is 10. The average collection period would then be 365 / 10 = 36.5 days.

Cash Conversion Cycle

The Cash Conversion Cycle (CCC) evaluates the time span to transform investments into cash flow. A lower CCC signifies superior AR management. Regularly compute and benchmark your CCC against industry standards to elevate your financial performance.

By tracking these AR performance indicators, you can optimize your accounts receivable process and enhance your company’s financial well-being.

Accounts Receivable vs. Accounts Payable: Key Differences

Grasping the distinction between accounts receivable (AR) and accounts payable (AP) is vital for adept financial management. AR signifies funds owed to a business, contrasting with AP, which denotes funds a business owes to its suppliers. We will dissect the pivotal differences between these financial entities.

AR is cataloged as an asset on the balance sheet, signifying potential future cash inflow. In stark contrast, AP is classified as a liability, indicating impending cash outflow. This fundamental disparity significantly influences a company’s cash flow and financial planning strategies.

The timing of these transactions varies. AR often involves granting credit to customers, with payment due within 30 to 90 days. AP, conversely, represents credit extended by suppliers, typically with analogous payment terms. Optimal management of both AR and AP can substantially bolster a company’s working capital.

| Aspect | Accounts Receivable (AR) | Accounts Payable (AP) |

|---|---|---|

| Definition | Money owed to the business | Money owed by the business |

| Balance Sheet Classification | Current Asset | Current Liability |

| Cash Flow Impact | Inflow when collected | Outflow when paid |

| Average Payment Terms | 30-90 days | 30-90 days |

| Management Challenge | 60% face tracking issues | 40% cost reduction with automation |

Effective AR management can elevate cash flow by 25%. Strategic AP management can also boost a company’s credit rating. The differences between AR and AP underscore the criticality of harmonizing incoming and outgoing cash flows for financial well-being.

Best Practices for Effective AR Management

Adopting accounts receivable best practices is essential for sustaining a healthy cash flow. We will examine pivotal AR management strategies that can profoundly enhance your financial operations.

Establishing Clear Payment Terms

Clear payment terms form the cornerstone of effective AR management. It is imperative to communicate due dates, accepted payment methods, and late payment policies clearly from the outset. Such transparency eradicates confusion and fosters timely payments.

Implementing Automated Systems

Automation revolutionizes AR management. Electronic billing and payment systems diminish errors and simplify record-keeping. Invoicing software optimizes payment processing, saving considerable time and ensuring precision. The accounts receivable automation market is anticipated to expand by 13.3% by 2030, underscoring its critical role.

Developing Collection Strategies

A comprehensive collection strategy is indispensable for sustaining cash flow. Utilizing automated reminders for payments enhances customer awareness. The goal is to maintain Days Sales Outstanding (DSO) below 30 days and achieve a Collection Effectiveness Index (CEI) near 100%. These metrics serve as benchmarks for evaluating the efficacy of your AR processes.

| AR Metric | Target | Impact |

|---|---|---|

| Days Sales Outstanding (DSO) | Below 30 days | Ensures timely collections |

| Collection Effectiveness Index (CEI) | Close to 100% | Indicates efficient collection processes |

| AR Turnover Ratio | High | Suggests need for process reassessment |

By integrating these AR management strategies, businesses can lower costs related to debt collection, enhance cash flow forecasting, and allocate resources for growth. Effective accounts receivable practices enable early identification of potential bad debts, facilitating timely interventions.

Introducing ti3: Modern AR Management Solution

In today’s fast-paced business world, managing accounts receivable poses a significant challenge. Enter ti3, a cutting-edge AR automation software designed to streamline financial processes. This accounts receivable management solution tackles common issues head-on, helping businesses improve cash flow and maintain strong customer relationships.

Automated Payment Reminders

ti3 eliminates the hassle of chasing payments. With automated reminders, you can significantly reduce late payments. Studies indicate that invoices with polite language, such as “thank you,” are settled 90% faster. ti3 incorporates these best practices, ensuring your reminders are both effective and courteous.

Streamlined Collection Process

Manual invoice processing can be costly, ranging from $2.07 to $10.00 per invoice. ti3 dramatically cuts these costs. By automating the collection process, ti3 reduces processing time from 10.1 days to just 3.9 days. This efficiency boost means you’ll spend less time on paperwork and more time growing your business.

Customer Relationship Preservation

While collecting payments is crucial, maintaining positive customer relationships is equally important. ti3 helps strike this balance. It offers flexible payment options and personalized communication, ensuring your customers feel valued while still encouraging prompt payment.

| Feature | Benefit |

|---|---|

| Automated Reminders | 90% faster payment settlement |

| Streamlined Processing | 60% reduction in processing time |

| Customer-Friendly Approach | Improved customer retention |

By leveraging ti3’s powerful features, businesses can significantly improve their accounts receivable management. This modern solution addresses key pain points, helping you get paid faster while keeping your customers happy.

Common Challenges in AR Management and Solutions

Businesses encounter numerous accounts receivable challenges that can severely impact their financial health. We will examine these issues and present effective AR management solutions.

Late Payment Issues

Late payments can significantly strain a company’s working capital, hindering its operations. A staggering 98% of C-level executives report that upper management deals with invoice disputes and payment problems. To address this, companies can implement clear credit policies and leverage automation for timely follow-ups.

Cash Flow Management

Effective cash flow management is vital for maintaining liquidity. Manual processes in accounts receivable often lead to payment delays, affecting a company’s ability to invest in growth. Implementing automated systems can streamline operations and improve cash flow.

Credit Risk Assessment

Accurate credit risk assessment is crucial to prevent bad debt accumulation. Regular review of customer creditworthiness is essential. By utilizing sophisticated reporting dashboards, businesses can monitor financial performance in real-time and make informed decisions.

| AR Challenge | Solution | Impact |

|---|---|---|

| Manual Processes | Automation | 40% increase in collection efficiency |

| Payment Delays | Digital Payment Options | 68% increase in ACH usage |

| Inaccurate Records | Centralized AR Data | 50% reduction in data management time |

By addressing these common accounts receivable challenges with innovative AR management solutions, businesses can enhance their financial stability and operational efficiency. Embracing digital transformation in AR processes is crucial to overcoming these hurdles and ensuring long-term success.

Conclusion

Effective accounts receivable management is crucial for business success. It transcends basic bookkeeping, influencing a company’s cash flow, financial stability, and growth. By adopting best practices and leveraging technology, businesses can optimize their AR processes. This leads to substantial benefits.

The advantages of AR management are profound. Companies focusing on their receivables often experience enhanced cash flow, reduced bad debt, and stronger customer ties. For example, efficient collection strategies can lower Days Sales Outstanding (DSO) and boost accounts receivable turnover. Such improvements contribute to better liquidity and overall financial health.

In today’s competitive landscape, refining AR processes is essential. Steps like setting clear payment terms and using automated systems offer opportunities for enhancement. Addressing issues like late payments and credit risk assessment can bolster financial stability. Effective AR management goes beyond mere payment collection. It involves nurturing enduring customer relationships while ensuring a robust financial foundation.

RelatedRelated articles