In the vibrant city of Houston, Texas, managing accounts receivable poses a significant challenge for businesses. A dependable collection agency in Houston Texas is indispensable. The city’s varied economic sectors, from energy to finance, necessitate professional debt recovery services to ensure a steady cash flow.

Houston’s debt profile diverges from national averages. Texans generally bear lower mortgage and student loan debts. Yet, their credit card balances are notably higher. This disparity underscores the critical need for specialized debt recovery services in Houston.

Southwest Recovery Services, situated on Westheimer Road, delivers expert accounts receivable management tailored for Texas businesses. They grasp the local economic nuances, offering customized solutions to efficiently recover outstanding debts.

Key Takeaways

- Houston’s economy requires specialized debt collection services

- Credit card debt in Texas exceeds the national average

- Professional agencies offer higher recovery success rates

- Timely engagement of collection services is crucial

- Local agencies understand Houston’s unique business landscape

- Debt recovery services help maintain healthy business cash flow

Understanding Debt Collection in Houston’s Economic Landscape

Houston’s economic environment poses distinct hurdles for businesses grappling with unpaid debts. The city’s financial framework, established in 1987 and expanded since, influences the dynamics of delinquent account collection. Grasping this context is essential for successful commercial debt collection in Houston.

Texas Economic Power and Debt Statistics

Texas holds considerable economic influence, significantly contributing to the national GDP. In Houston, the issue of unpaid debts threatens the financial health of businesses. Local commercial collection agencies leverage their knowledge of regional laws to craft effective debt recovery strategies.

Houston’s Unique Debt Profile

Houston’s debt profile diverges from the national norm. The city’s financial regulations, such as the Budget Stabilization Fund or “Rainy Day Fund,” play a pivotal role in debt management. By partnering with proficient commercial collection firms, Houston businesses can save 20-30% of time previously spent on debt pursuit.

Impact of Time on Debt Recovery Success

Time is a critical factor in debt recovery success. The Dushkin Law Firm achieves an 85% average recovery rate, underscoring the need for swift action. Customized strategies enhance success rates by 15% over generic approaches. In roughly 30% of cases, specialized legal expertise is required for complex scenarios necessitating legal intervention.

| Aspect | Impact |

|---|---|

| Time Saved | 20-30% |

| Recovery Rate | 85% |

| Tailored Approach Success | 15% increase |

| Cases Needing Legal Expertise | 30% |

Signs It’s Time to Partner with a Collection Agency in Houston Texas

Identifying the right moment to engage professional debt recovery services is vital for businesses in Houston. Credit collections Houston services can dramatically enhance your debt recovery prospects. Let’s examine the critical indicators that suggest it’s time to collaborate with a collection agency.

Non-responsive Customer Indicators

Consistent disregard for payment reminders from customers is a clear warning sign. Medical debt collectors Houston are equipped to handle such challenging scenarios. They employ advanced strategies and tools to effectively engage with unresponsive debtors.

Payment Plan Violations

Customers who breach payment plans are ideal candidates for professional debt collection. A collection agency can enforce these agreements and negotiate revised terms if needed.

Denial of Responsibility Cases

Debtors who deny owing money or dispute the debt amount pose a significant challenge. In such instances, seasoned debt collectors can validate the debt and present compelling evidence to support your claim.

| Warning Sign | Action Required |

|---|---|

| Repeated ignored invoices | Engage credit collections Houston |

| Broken payment agreements | Seek professional enforcement |

| Debt disputes | Utilize medical debt collectors Houston for verification |

Remember, partnering with a collection agency early can significantly boost your debt recovery success. Don’t delay – act swiftly when you notice these warning signs to safeguard your business’s financial well-being.

Professional Debt Recovery Services in Houston

Houston’s debt recovery scene is transforming with the advent of cutting-edge tools and methodologies. Third party collections Texas entities are enhancing their capabilities to fulfill the escalating needs of enterprises in pursuit of effective debt resolution strategies.

Cutting-Edge Collection Tools

Legal collections Houston entities leverage advanced technology to optimize the debt collection process. This technology encompasses automated payment notifications, digital documentation frameworks, and sophisticated skip tracing software. Such advancements markedly elevate collection efficacy and success metrics.

Ensuring Legal Compliance

Professional debt collectors in Houston emphasize legal adherence. They meticulously follow federal and state laws, including the Fair Debt Collection Practices Act. This dedication safeguards both creditors and debtors, ensuring the integrity and legality of collection practices.

Impressive Recovery Rates

Houston’s premier debt recovery agencies exhibit outstanding success rates. Some notable achievements include:

- 100% success rate in commercial debt collection

- 50% cost reduction through First Call Programs

- Custom-designed workflows for each case

These figures underscore the prowess of professional debt recovery services in Houston. With seasoned management teams and bespoke strategies, these entities deliver solutions across diverse sectors, encompassing healthcare to small enterprises.

The ti3 Platform: Modern Debt Recovery Solution

In the domain of outsourced collections Houston and accounts receivable management Texas, the ti3 platform emerges as a pioneering solution. It transforms debt recovery with its sophisticated features and client-focused methodology.

Automated Payment Reminders

The ti3 platform simplifies the debt recovery process with automated payment reminders. This innovation ensures timely debtor communication, enhancing recovery success rates. It empowers businesses to conduct consistent follow-ups without overextending their resources.

Escalation Management System

Regarding accounts receivable management Texas, the ti3 platform introduces a powerful escalation management system. This mechanism facilitates a structured approach to managing intricate cases. It guarantees swift and effective handling of difficult debt scenarios, thus optimizing recovery outcomes.

Client Relationship Preservation

The ti3 platform’s standout feature in outsourced collections Houston is its commitment to preserving client relationships. It employs diplomatic communication tactics, ensuring professional interactions while pursuing debt recovery. This strategy aids in recovering funds while safeguarding crucial customer ties.

The ti3 platform represents a holistic solution for contemporary debt recovery demands. Its automated functionalities, escalation management, and client-centric approach render it an essential asset for businesses aiming for effective accounts receivable management in Texas and beyond.

Commercial Debt Collection Process

Commercial debt collection in Houston employs a strategic approach to recover unpaid balances. The process is divided into several stages, each aimed at maximizing recovery while preserving professional relationships.

Debt recovery in Houston starts with initial contact. Agencies send demand letters and make phone calls to debtors. If these efforts fail, the process escalates. Some agencies, like Mesa Revenue Partners, offer a “No Fee Unless Money is Recovered” policy. This ensures clients only pay for successful recoveries.

The next phase involves more intensive measures. This may include credit reporting to major bureaus like Experian, Equifax, and Transunion. For instance, First Federal Credit Control (FFCC) reports accounts after 45 days of placement.

If necessary, the final stage may involve legal action. Agencies with nationwide attorney networks can recommend this step as a last resort. Throughout the process, agencies like FFCC provide live notes, timely updates, and success rate reports to their clients.

| Collection Stage | Actions | Timeline |

|---|---|---|

| Initial Contact | Demand letters, phone calls | 1-30 days |

| Escalation | Credit reporting, intensive follow-ups | 31-60 days |

| Legal Action | Attorney involvement, litigation | 61+ days |

Successful commercial debt collection requires industry knowledge, regional understanding, and tactful communication. In Houston’s diverse business landscape, agencies must adapt their strategies to serve various industries effectively.

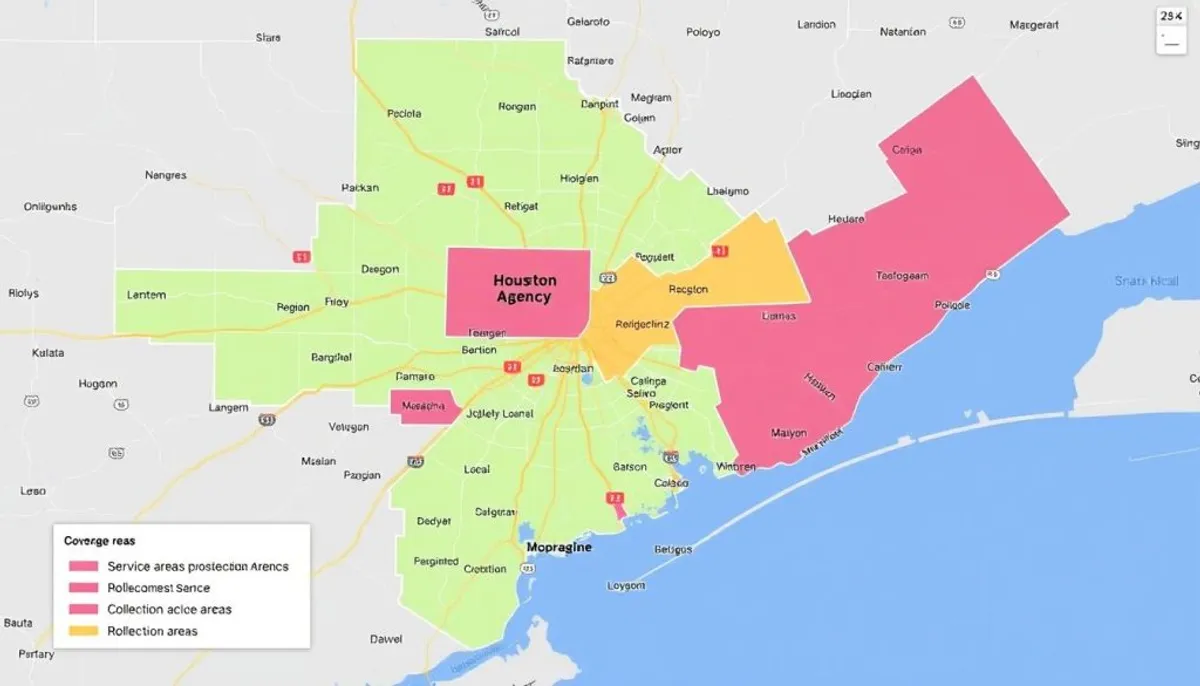

Geographic Coverage and Service Areas

A premier collection agency in Houston, Texas, spans the state’s vast expanse. These entities are adept at navigating Texas’s economic terrain, customizing their offerings to meet local needs.

Houston Metropolitan Area

The core of many third-party collections in Texas lies within the dynamic Houston metropolitan area. This zone encompasses pivotal economic centers such as Downtown, Energy Corridor, and Midtown. Professionals here possess in-depth knowledge of local business norms and regulatory frameworks.

Surrounding Counties

Services extend beyond Houston’s city limits. Agencies cater to cities like Sugar Land, Katy, The Woodlands, and Pearland. This expansive coverage enables them to tackle debt recovery across a variety of communities and sectors.

State-wide Services

Several collection agencies in Houston, Texas, provide services statewide. From Dallas to Austin, and from San Antonio to El Paso, they apply their specialized knowledge to efficiently collect debts across Texas.

| Region | Major Cities Served | Industries Covered |

|---|---|---|

| Houston Metro | Houston, Sugar Land, Katy | Energy, Healthcare, Finance |

| East Texas | Beaumont, Tyler, Longview | Oil & Gas, Agriculture, Manufacturing |

| North Texas | Dallas, Fort Worth, Arlington | Technology, Telecom, Retail |

| Central Texas | Austin, San Antonio, Waco | Tech Startups, Education, Government |

Legal Framework and Compliance

Debt collection agencies in Houston operate under a complex legal framework. The Texas Debt Collection Act governs creditors, while the Fair Debt Collection Practices Act (FDCPA) oversees professional debt collectors. These laws are designed to safeguard consumers from exploitative practices in legal collections Houston.

Credit collections Houston agencies must follow strict guidelines. They are prohibited from making calls at unreasonable hours or employing threats. Those who violate these rules may face both criminal and civil penalties. Agencies are also barred from taking action on disputed debts until they’ve confirmed the debt’s accuracy within 30 days.

Texas law extends some protections to debtors. Homesteads are generally exempt from seizure, except for specific debts like mortgages. Wage garnishment is restricted to certain debt types, such as child support.

| Regulation | Key Points |

|---|---|

| Texas Debt Collection Act | Regulates creditors, prohibits abusive tactics |

| Fair Debt Collection Practices Act | Governs professional collectors, sets communication rules |

| Texas Homestead Protection | Safeguards homes from most debt collections |

| Wage Garnishment Limits | Restricts wage seizure to specific debt types |

Reputable credit collections Houston agencies prioritize legal compliance. They employ specialized tools and maintain accurate documentation to uphold ethical standards. This approach not only safeguards debtors but also enhances the reputation of their clients.

Benefits of Professional Debt Recovery Services

Professional debt recovery services bring significant advantages to businesses in Houston. They excel in delinquent account collection, offering cost-effective solutions and optimizing resources.

Cost-Effective Solutions

Many reputable collection agencies in Texas operate on a contingency fee basis. This means you only pay when they successfully recover your bad debts. This approach ensures that outsourced collections in Houston remain affordable and risk-free for businesses.

Higher Recovery Success Rates

Professional debt recovery services boast impressive success rates. For instance, some agencies complete over 80% of debt collections within 3 to 5 business days. This efficiency stems from their specialized expertise and extensive networks. Some agencies maintain connections with over 12,000 credit-trained field investigators and attorneys across all 50 states.

Time and Resource Optimization

Outsourcing debt collection frees up your time and resources. It allows you to focus on core business operations while experts handle the complexities of debt recovery. These professionals ensure prompt handling of due accounts, maintain accurate records, and preserve positive business relationships during the collection process.

By partnering with a professional debt recovery service, you gain access to specialized tools, legal compliance expertise, and improved cash flow management. This combination of benefits makes professional debt recovery an invaluable asset for businesses in Houston’s competitive economic landscape.

Conclusion

In Houston’s diverse economic landscape, professional debt recovery services are indispensable. A reputable collection agency in Houston Texas can adeptly navigate the intricate legal terrain. This ensures adherence to both state and federal regulations. Given the four-year statute of limitations on most debts, prompt action is paramount for effective recovery.

The ti3 platform introduces cutting-edge solutions for debt recovery in Houston. It simplifies the collection process, maintaining client relationships intact. This forward-thinking strategy, coupled with the acumen of professional agencies, notably enhances recovery success across various sectors.

Engaging a collection agency in Houston Texas is a strategic decision for businesses confronting unresponsive customers or payment plan breaches. These agencies present cost-effective remedies, elevate success probabilities, and optimize time and resources. By employing specialized tools and local acumen, they deliver bespoke debt recovery strategies Houston companies require in today’s fast-paced business milieu.

RelatedRelated articles