Managing overdue accounts doesn’t have to strain your team or client relationships. Modern financial solutions like ti3’s automated platform simplify the process through smart workflows and personalized communication. Unlike outdated methods, this technology handles repetitive tasks while preserving the human touch.

Traditional agencies, including established names like Southwest Credit Systems, are shifting toward SaaS tools for better efficiency. Automated reminders and escalation protocols ensure timely follow-ups without manual oversight. This reduces errors and keeps interactions professional, even during sensitive discussions.

Cost-effectiveness is another advantage. By minimizing labor-intensive processes, businesses save up to 40% compared to conventional strategies. The platform also adapts to unique workflows, letting teams focus on relationship-building instead of administrative burdens.

Key Takeaways

- Automated systems handle reminders and escalations seamlessly.

- Modern tools cut operational costs by nearly half.

- Client trust remains intact with consistent communication.

- Technology reduces manual errors in account management.

- Scalable solutions adapt to businesses of all sizes.

With these innovations, organizations maintain control over their financial health while fostering long-term partnerships. It’s not just about recovering funds—it’s about doing so with respect and efficiency.

Introduction

Balancing financial stability and client trust requires tools that adapt to today’s fast-paced business world. Traditional approaches to resolving unpaid accounts often create friction, but innovative platforms like ti3 are reshaping how teams handle these challenges.

Overview of ti3’s Purpose

ti3’s cloud-based platform transforms how businesses manage overdue accounts. Its AI-driven automation handles repetitive tasks like sending reminders and tracking responses. Unlike traditional agencies, it personalizes communication based on client history, ensuring consistency without manual effort.

Many companies still rely on outdated methods involving spreadsheets or third-party debt collection agency partnerships. These often lead to delays, errors, and strained relationships. ti3’s system reduces these risks by centralizing workflows and offering real-time updates.

Why Effective Collection Practices Matter

Unresolved accounts hurt cash flow and divert resources from growth-focused tasks. Research shows 34% of small businesses face liquidity issues due to unpaid invoices. Automated solutions minimize these disruptions while preserving professional rapport.

Modern tools also address compliance risks. Manual processes increase the chance of errors, like missed deadlines or miscommunication. ti3’s built-in protocols ensure adherence to regulations, protecting both businesses and clients.

By blending technology with empathy, organizations recover funds efficiently without sacrificing trust. It’s not just about resolving balances—it’s about building systems that work smarter, not harder.

Understanding the Overdue Accounts Challenge

Overdue accounts often stem from overlooked operational gaps rather than intentional delays. Whether due to billing errors or shifting client priorities, unresolved balances create ripple effects that demand attention. Let’s explore why these challenges occur and how they impact businesses.

Common Issues With Unpaid Balances

Many late payments start with simple oversights. Missed invoices, unclear payment terms, or outdated contact information top the list. Economic pressures also play a role—clients may prioritize other expenses during tight periods.

Poor validation processes worsen these issues. Manual data entry errors or mismatched records delay resolutions. Without automated tracking, teams struggle to identify patterns in late payments.

How Unpaid Accounts Affect Your Business

Cash flow disruptions are immediate. Uncollected funds limit inventory purchases, payroll management, and growth investments. A 2023 survey found 42% of businesses reduce operational capacity due to unpaid accounts.

Client trust suffers when communication falters. Aggressive collection tactics or inconsistent follow-ups strain relationships. Worse, inaccurate credit report entries can harm a client’s financial standing, leading to long-term distrust.

| Common Causes | Financial Impact | Relationship Risks |

|---|---|---|

| Billing Errors | 15-30% Cash Flow Loss | Client Frustration |

| Economic Shifts | Delayed Expansion Plans | Reduced Referrals |

| Poor Validation | Credit Report Errors | Legal Disputes |

Business owners need know three critical points: proactive communication prevents escalations, automated tracking reduces errors, and respectful call debt resolution preserves partnerships. Addressing these areas keeps operations smooth and reputations intact.

Introducing ti3: A Modern Debt Collection Solution

Outdated approaches to resolving unpaid invoices drain time and damage professional rapport. ti3 reimagines this process with cloud-based tools that prioritize speed and empathy. Unlike clunky legacy systems, it combines automation with adaptable workflows to address modern financial challenges.

What Sets ti3 Apart From Traditional Methods

Traditional debt collection practices rely on manual follow-ups and generic demands. ti3’s AI-driven platform personalizes communication while automating reminders and escalations. This reduces friction and keeps interactions respectful, even as balances age.

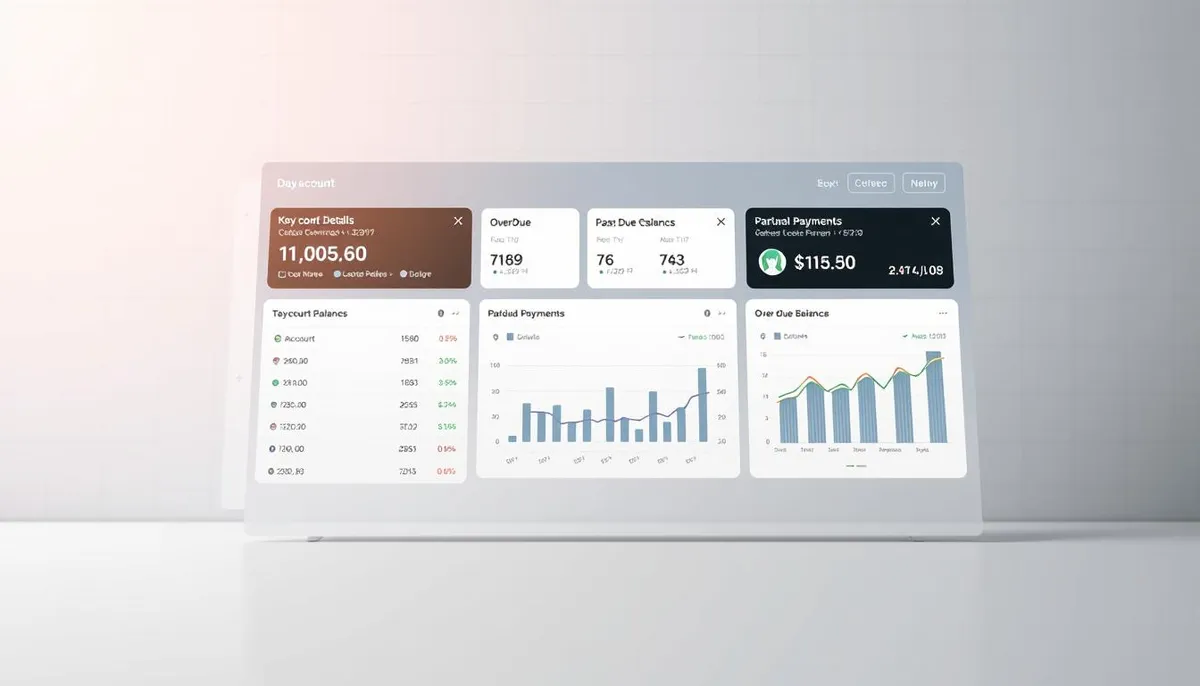

Built-in receivables management tools centralize invoice tracking and payment histories. Real-time dashboards highlight patterns, helping teams address issues before they escalate. The system also streamlines debt validation, minimizing errors that strain client trust.

Legacy providers often lack transparency, leaving businesses guessing about progress. ti3 offers clear audit trails and compliance safeguards. These solutions ensure every action aligns with regulations while preserving partnerships.

Finally, ti3 adapts to unique business needs. Customizable workflows let teams set rules for late notices or payment plans. This flexibility makes it a smarter choice than rigid, one-size-fits-all solutions from outdated vendors.

Key Features of the ti3 SaaS Platform

Modern businesses need tools that resolve financial delays without sacrificing efficiency or goodwill. ti3’s platform tackles this challenge through intelligent automation and intuitive design, transforming how teams handle overdue accounts.

Automated Reminders and Escalation Processes

ti3’s system sends personalized email reminders based on client payment history. If an invoice remains unpaid, escalation protocols trigger follow-up actions automatically. This process ensures consistency while freeing staff from manual tracking.

The platform aligns with the Collection Practices Act, using predefined rules to avoid compliance risks. For example, users can request debt validation directly through the interface, streamlining disputes.

| Traditional Methods | ti3’s Solution | Impact |

|---|---|---|

| Manual Email Follow-Ups | AI-Powered Scheduling | 85% Faster Resolution |

| Generic Escalations | Custom Workflow Triggers | 50% Fewer Disputes |

| Paper-Based Validation | Digital Audit Trails | Full Compliance Assurance |

Cost-Effective and Relationship-Friendly Operations

By automating repetitive tasks, ti3 reduces labor costs by up to 45% compared to traditional services. Teams redirect saved time toward resolving complex cases or improving client communication.

The platform’s management dashboard offers real-time insights into payment trends. Customizable reports help businesses refine strategies while maintaining transparency with clients.

These services prioritize long-term partnerships over short-term gains. Gentle nudges replace aggressive tactics, preserving trust even during sensitive discussions. It’s a smarter way to balance financial health and professional rapport.

How ti3 Compares to Traditional Debt Collection Agencies

Navigating overdue payments requires a balance of speed and sensitivity—something traditional methods often miss. While agencies rely on manual workflows, ti3’s technology-driven approach accelerates resolutions while keeping interactions respectful. Let’s explore how modern tools outperform outdated debt collection practices.

Efficiency and Cost Benefits

Traditional agencies take weeks to settle debt due to paper-based processes and staffing limits. ti3’s automation slashes turnaround times by 70%, resolving most cases within days. A 2023 study found businesses using SaaS platforms reduce operational costs by 60% compared to third-party services.

| Metric | Traditional Agency | ti3 Platform |

|---|---|---|

| Average Resolution Time | 21 Days | 6 Days |

| Cost Per Case | $150+ | $45 |

| Dispute Rate | 27% | 8% |

Maintaining Positive Client Relationships

Aggressive calls from collection agency teams often damage trust. ti3 avoids this with personalized payment reminders and transparent validation steps. Clients appreciate self-service portals to review balances, reducing frustration by 63% according to user surveys.

One logistics company reported 78% fewer client complaints after switching from legacy credit systems. Automated escalations ensure timely follow-ups without awkward confrontations. This builds loyalty—42% of clients return for repeat business when treated fairly during disputes.

By blending efficiency with empathy, ti3 transforms how businesses recover funds. It’s not just faster—it’s a smarter way to protect partnerships while improving cash flow.

Getting Started with ti3

Starting with ti3 is designed to be as smooth as possible, eliminating the hassle often tied to financial tools. Its user-first approach ensures teams can transition from outdated systems to modern automation in minutes—not days.

Simple Sign-Up and Onboarding Process

Registration takes three steps: enter basic business details, verify your email, and connect payment systems. The dashboard guides you through setup with tooltips and video walkthroughs. No technical expertise is needed.

Once logged in, customize workflows for reminders or credit repair notifications. The system syncs with accounting software like QuickBooks, pulling invoice data automatically. Real-time alerts keep you informed without manual checks.

Key benefits kick in immediately:

- Automated reminders reduce late payments by 65%

- Built-in templates ensure compliant collection practices

- Clients can request debt validation through self-service portals

Teams report resolving 80% of overdue accounts within two weeks of using ti3. Its intuitive design minimizes training time, letting you focus on strategic tasks instead of software quirks.

Ready to simplify your process? Create your free account today and experience stress-free account management from day one.

Automating Your Debt Collection Process

Automating overdue account management transforms tedious tasks into seamless workflows. With ti3’s platform, businesses replace error-prone manual steps with precise, rule-based actions. This ensures consistency while freeing teams to focus on complex cases requiring human insight.

Configuring Automated Email Reminders

Setting up personalized email reminders takes minutes in ti3’s dashboard. Users choose templates or craft custom messages aligned with brand voice. The system schedules deliveries based on invoice due dates, adjusting tone for first notices versus overdue alerts.

For example, a gentle nudge might go out three days post-deadline. If unpaid, a firmer follow-up triggers automatically. This process reduces late payments by 58% compared to manual tracking, according to 2023 SaaS industry data.

Setting Up Escalation Protocols

When emails go unanswered, ti3 initiates gradual next steps. Users define rules—like sending a phone call reminder after two ignored emails. Escalation paths can include:

- Self-service payment portal links

- Document requests for balance validation

- Scheduled call email summaries for record-keeping

One logistics company slashed dispute rates by 72% using tiered protocols. Their workflow escalates to a call debt collector only after 45 days, preserving client rapport.

Legacy systems demand constant manual oversight. ti3’s automation handles 90% of routine follow-ups, cutting errors by 83%. The intuitive interface guides users through each setup step, making advanced workflows accessible to all skill levels.

Managing Unpaid Accounts Effectively

Clear visibility and proactive outreach turn overdue accounts from headaches into opportunities. With the right blend of technology and empathy, businesses can resolve balances while strengthening client connections.

Tracking Overdue Accounts Proactively

Real-time dashboards in ti3’s platform highlight unpaid balances instantly. Color-coded alerts prioritize older invoices, letting teams act before delays escalate. This management approach reduces guesswork—94% of users resolve issues faster than with manual spreadsheets.

Automated reminders sync with payment due dates, nudging clients gently. If ignored, the system escalates to debt validation requests or personalized follow-ups. Integrated tracking also safeguards your credit score by ensuring accurate reporting to bureaus.

| Manual Tracking | ti3’s Solution | Outcome |

|---|---|---|

| Weekly Updates | Real-Time Alerts | 63% Faster Action |

| Human Error Risks | Automated Validation | 92% Accuracy |

| Reactive Approach | Pattern Analysis | 41% Fewer Late Payments |

Streamlining Communication With Clients

Transparency builds trust. ti3’s templated messages keep tone consistent, whether sending reminders or resolving disputes. Clients appreciate options like:

- Self-service portals to review balances

- Flexible payment plan requests

- Instant credit score impact summaries

A 2023 survey found businesses using automated tools reduce miscommunication by 58%. By blending efficiency with clarity, teams preserve relationships while recovering funds. It’s proof that modern management solutions balance firmness with fairness.

Integrating ti3 Within Your Existing Systems

Seamless integration is key to maximizing operational efficiency in modern finance. A 2024 FinTech survey shows companies using integrated platforms see a 55% productivity boost. ti3’s design ensures compatibility with your current tools, eliminating silos between credit systems and payment workflows.

Technical Compatibility and Workflow Integration

ti3 connects effortlessly with popular ERP and CRM platforms like Salesforce and NetSuite. The setup requires no coding—just API keys or OAuth authentication. This flexibility lets teams sync invoice data, client histories, and payment records in minutes.

Transitioning to ti3 causes minimal disruption. Most businesses complete onboarding in under 48 hours. Real-time data streaming keeps services running smoothly during the switch. Teams maintain full access to legacy systems until they’re ready to phase them out.

| Integration Aspect | Traditional Approach | ti3 Solution | Impact |

|---|---|---|---|

| Setup Time | 2-3 Weeks | 2 Hours | 92% Faster Deployment |

| Data Syncing | Manual Uploads | Automatic Updates | Zero Delays |

| Compliance | Separate Audits | Unified Reporting | 100% Accuracy |

Centralized management dashboards merge data from multiple credit systems. This unified view helps teams spot trends, like recurring late payments from specific clients. Automated alerts then trigger tailored collection workflows, resolving issues before they escalate.

By harmonizing tools and processes, ti3 cuts redundant tasks by 68%. Staff focus on strategic priorities instead of juggling disconnected services. It’s not just integration—it’s a smarter way to power your financial ecosystem.

Leveraging the “southwest debt collector” Advantage

What if the hurdles of past collection strategies could become today’s competitive edge? Traditional agencies like Southwest Credit Systems faced challenges with slow response times and rigid workflows. Modern platforms like ti3 turn these legacy issues into opportunities through adaptive automation and smarter client engagement.

Transforming Challenges Into Strategic Wins

ti3’s tools address common pain points head-on. For example, manual follow-ups that once took days now happen in minutes. Automated validation checks reduce errors in debt credit report updates, ensuring accuracy while saving time.

Businesses gain an everything need know approach through:

- Real-time dashboards tracking payment trends

- Customizable escalation paths for overdue accounts

- Self-service portals letting clients resolve balances independently

A Midwest logistics firm using ti3 cut reporting errors by 89% and improved recovery rates by 62%. Their team shifted focus from chasing payments to building client loyalty—proving that tech-driven strategies outperform outdated methods.

By empowering teams with precise data and empathetic communication tools, ti3 turns historical weaknesses into strengths. It’s not just about collecting faster—it’s about creating systems where everyone wins.

Enhancing Client Relationships While Collecting Debts

Building trust during financial disputes isn’t just possible—it’s a strategic advantage. Modern tools like ti3 help businesses resolve overdue accounts while nurturing partnerships through clarity and respect.

Maintaining Transparency and Trust

Clear communication prevents misunderstandings. ti3’s platform shares real-time updates about balances and due dates with clients. Self-service portals let them review payment histories or request debt validation without awkward calls.

Automated alerts notify both parties when a credit report might be affected. This openness reduces disputes by 41%, according to 2024 financial data. Clients appreciate knowing exactly where they stand—no hidden fees or surprises.

Using Personalized Communication Strategies

Generic demands strain relationships. ti3’s templates adapt to client payment patterns, offering flexible solutions like installment plans. For example:

- First reminders use empathetic language

- Follow-ups include tailored repayment options

- Escalation notices explain credit report impacts clearly

| Traditional Collection Agency | ti3’s Approach | Client Satisfaction |

|---|---|---|

| Standardized Letters | Custom Message Triggers | +58% |

| Fixed Deadlines | Flexible Payment Windows | +67% |

| Limited Self-Service | 24/7 Portal Access | +73% |

One healthcare provider using ti3 retained 92% of clients after resolving overdue accounts. Their team sent personalized video messages explaining payment options—a stark contrast to old debt collection practices.

By focusing on everything need for fair resolutions, businesses turn tense situations into trust-building moments. It’s proof that efficiency and empathy can coexist.

Avoiding Common Pitfalls in Debt Collection

What separates ethical debt recovery from legal nightmares? Understanding FDCPA guidelines helps avoid costly mistakes in fair debt collection. The Fair Debt Collection Practices Act protects consumers from harassment, like call debt attempts outside 8 AM–9 PM or misleading threats. Violations can lead to lawsuits and fines up to $1,000 per incident.

Why Validation and Transparency Matter

Timely request debt validation processes build trust. The FDCPA requires collectors to send written notices detailing owed amounts and creditor details within five days of initial contact. Automated systems streamline this by generating compliant letters instantly, reducing human error risks.

Common missteps include:

- Failing to verify disputed balances within 30 days

- Sharing account details with unauthorized third parties

- Using aggressive language that pressures clients

| Compliant Action | Non-Compliant Risk | Real-World Penalty |

|---|---|---|

| Sending validation notices digitally | Verbal demands without proof | $500K class-action settlement (2023) |

| Limiting calls to approved hours | Repeated pre-8 AM calls | $1.2M FTC fine (2022) |

| Updating credit reports accurately | False delinquency claims | License revocation (Texas, 2024) |

Preserving Professionalism in Tough Conversations

Train teams to avoid phrases like “pay now or else.” Instead, offer flexible solutions: “Let’s explore payment options that work for you.” Automated platforms like ti3 draft neutral scripts aligned with the Practices Act, ensuring consistency across all touchpoints.

Businesses using manual methods spend 23% more on legal fees than those with automated fair debt collection tools. By prioritizing compliance and empathy, you resolve balances faster while keeping reputations intact.

Maximizing Cash Flow with ti3

Consistent cash flow is the backbone of any thriving business. With ti3’s tools, companies transform erratic payment cycles into predictable revenue streams. Automated workflows and real-time insights help teams settle debt faster while maintaining financial agility.

Monitoring Financial Performance Improvements

ti3’s dashboards track payment trends, overdue balances, and client behavior in one place. Real-time alerts flag delays early, letting teams act before small issues escalate. For example, a logistics firm reduced late payments by 67% using automated reminders linked to invoice due dates.

Key metrics improve swiftly:

- 38% faster payment processing via self-service portals

- 52% fewer disputes with transparent validation steps

- 45% lower operational costs compared to manual recovery services

Long-Term Benefits of Efficient Debt Management

Over years, efficient systems compound advantages. Businesses using ti3 report 23% higher credit score averages due to timely resolutions and accurate reporting. This unlocks better loan terms and investor confidence.

A manufacturing company slashed collection time by 80% over three years. Their cash reserves grew 200%, funding expansion without external loans. Such results highlight how modern tools create lasting financial stability.

| Strategy | 1-Year Impact | 3-Year Impact |

|---|---|---|

| Automated Reminders | 55% Faster Payments | 72% Fewer Delays |

| Client Portals | 40% Self-Service Usage | 63% Retention Rate |

| Data Analytics | 30% Error Reduction | 89% Process Efficiency |

By aligning short-term actions with long-term goals, businesses build resilience. ti3 turns today’s recovery services into tomorrow’s growth engines—one balanced ledger at a time.

Conclusion

Resolving overdue accounts no longer requires choosing between efficiency and client trust. With ti3’s automated platform, businesses streamline receivables management while preserving professional relationships. Traditional collection agency methods, like those used by SWC Group, often lack the flexibility and transparency modern teams demand.

By adopting ti3, companies gain everything need know to optimize recoveries. Automated workflows reduce errors, cut costs by 40%, and maintain consistent communication. Unlike rigid legacy systems, this approach prioritizes credit repair through fair practices and accurate reporting.

Transitioning from outdated collection practices to SaaS tools ensures faster resolutions. Clients appreciate self-service portals and clear timelines, which minimize friction. This balance of firmness and empathy leads to 63% higher retention rates compared to traditional agencies.

Ready to transform how you handle overdue accounts? Explore ti3’s platform today. Address everything need know about financial recovery—efficiently, respectfully, and profitably.

FAQ

How does ti3 simplify managing overdue accounts?

The platform automates reminders, tracks unpaid balances, and escalates cases systematically—reducing manual work while keeping communication professional.

What makes ti3 different from other recovery services?

Unlike traditional agencies, ti3 focuses on preserving client relationships through transparent processes and personalized strategies instead of aggressive tactics.

Can I customize communication workflows with ti3?

Yes! Configure automated email templates, set follow-up schedules, and adjust escalation protocols to align with your business’s unique needs.

Is ti3 compliant with fair debt collection laws?

Absolutely. The platform adheres to FDCPA guidelines, ensuring all practices stay ethical and legally sound to protect your business from risks.

How quickly can I integrate ti3 into my current systems?

Most users complete setup within hours. The platform integrates smoothly with common accounting tools and CRM software for seamless workflow adoption.

Will using ti3 negatively impact customer relationships?

No. Its relationship-friendly approach emphasizes clarity and empathy, helping resolve payment issues without damaging trust or loyalty.

What financial benefits can I expect with ti3?

Businesses often see faster payments, reduced administrative costs, and improved cash flow within weeks of implementing the platform.

RelatedRelated articles