Managing accounts receivable is a complex task for businesses of all sizes. An effective accounts receivable system is vital for maintaining healthy cash flow and ensuring timely payments from clients. This guide will explore best practices and provide useful templates to streamline your invoice tracking process.

We’ll introduce ti3, a cutting-edge SaaS platform designed to revolutionize how companies handle overdue unpaid accounts. By automating reminders and facilitating payment collection, ti3 offers a cost-effective solution for businesses looking to improve their accounts receivable management.

Key Takeaways

- Effective accounts receivable management is essential for maintaining healthy cash flow

- Automated systems like ti3 can streamline the invoice tracking process

- Clear credit terms and payment deadlines are crucial for successful AR management

- Regular monitoring of key performance indicators helps optimize AR processes

- Implementing digital invoicing can significantly reduce processing time

- Offering multiple payment options increases the likelihood of timely payments

Understanding Example Accounts Receivable and Its Importance

Accounts receivable is a cornerstone of a company’s financial well-being. It signifies the outstanding invoices or monies owed to a business for goods or services rendered. This metric is indispensable for managing customer billing and forecasting cash flow.

Definition and Basic Concepts

Accounts receivable is categorized as a current asset on a company’s balance sheet. Businesses often establish payment terms spanning from a few days to a year. The accounts receivable turnover ratio gauges how frequently a company collects its receivables within an accounting period.

Role in Business Financial Health

Effective management of accounts receivable is paramount for sustaining a robust cash flow. Days Sales Outstanding (DSO) quantifies the average duration to collect payments post-sale. A reduced DSO signifies superior cash flow management. Companies leverage accounts receivable as collateral for short-term loans, underscoring its significance in financial operations.

Impact on Cash Flow Management

The nexus between accounts receivable and cash flow is pivotal. A shorter average collection period augments liquidity. Accurate cash flow forecasting hinges on adept AR management. The Cash Conversion Cycle (CCC) evaluates the total duration to transform cash into inventory and back into cash through sales and collections.

| Metric | Description | Impact |

|---|---|---|

| DSO | Average days to collect payment | Lower is better for cash flow |

| AR Turnover Ratio | Frequency of collecting receivables | Higher indicates efficient collection |

| CCC | Time to convert cash through sales cycle | Shorter cycle improves cash management |

By optimizing the AR process, tools like ti3 can markedly enhance cash flow management and customer billing efficiency. This automated system diminishes human error, enabling businesses to concentrate on expansion while preserving consistent cash flow.

Essential Components of an AR System

An effective accounts receivable (AR) system is crucial for maintaining healthy cash flow and strong customer relationships. The key elements of a robust AR system work together to streamline payment processing and collections management.

Customer information management forms the foundation of any AR system. Accurate and up-to-date customer data ensures smooth communication and billing processes. Invoice generation comes next, creating clear and detailed bills that leave no room for confusion.

Payment terms are another vital component. Setting clear expectations for payment deadlines helps reduce late payments. In fact, businesses that communicate payment terms effectively can increase on-time payments by 30% or more.

- Customer information management

- Invoice generation

- Payment terms

- Tracking mechanisms

- Automated reminders

Tracking mechanisms are essential for monitoring the status of each invoice and payment. These tools help businesses stay on top of their AR and take prompt action when needed. Automated reminders play a significant role in improving collection rates, often by 20-30% compared to manual methods.

| Component | Impact on AR |

|---|---|

| Automated Invoicing | Reduces errors to 5% or less |

| Clear Payment Terms | Increases on-time payments by 30% |

| Automated Reminders | Improves collection rates by 20-30% |

| AR Aging Reports | Reduces overdue accounts by up to 24% |

By incorporating these essential components, businesses can significantly improve their AR processes, reduce late payments, and maintain a healthy cash flow. Modern AR systems like ti3 integrate these elements seamlessly, offering comprehensive solutions for efficient payment processing and collections management.

Establishing Effective AR Policies and Procedures

Creating robust accounts receivable (AR) policies is essential for maintaining a healthy cash flow. Clear guidelines are crucial in minimizing late payments and reducing credit risk. Let’s explore the key components of effective AR management.

Creating Clear Credit Terms

Implementing a credit application process is vital for assessing customer creditworthiness. It’s important to check applicants’ credit history and request references from other companies, notably for high-volume orders. This approach aids in accounts aging and credit risk analysis.

Setting Payment Deadlines

Industry-standard payment terms usually span 30 days. It’s crucial to clearly communicate due dates on invoices to avoid confusion. Offering early payment discounts can encourage prompt settlements. Digital invoicing can streamline this process for businesses managing numerous clients.

Developing Collection Protocols

Establish a systematic approach for handling overdue accounts:

- Categorize unpaid invoices (0-30, 31-60, 61-90, 90+ days)

- Send reminders at set intervals

- Escalate to phone calls or third-party collection agencies after specified deadlines

Automated systems like ti3 can efficiently track invoices and manage the collection process, proving more cost-effective than traditional debt collection agencies.

| AR Management KPI | Goal |

|---|---|

| Days Sales Outstanding (DSO) | < 45 days |

| Collection Effectiveness Index (CEI) | > 80% |

| Bad Debt to Sales Ratio | < 2% |

By implementing these strategies and leveraging tools for accounts aging and credit risk analysis, businesses can enhance their AR management. This ensures a healthy cash flow while preserving valuable client relationships.

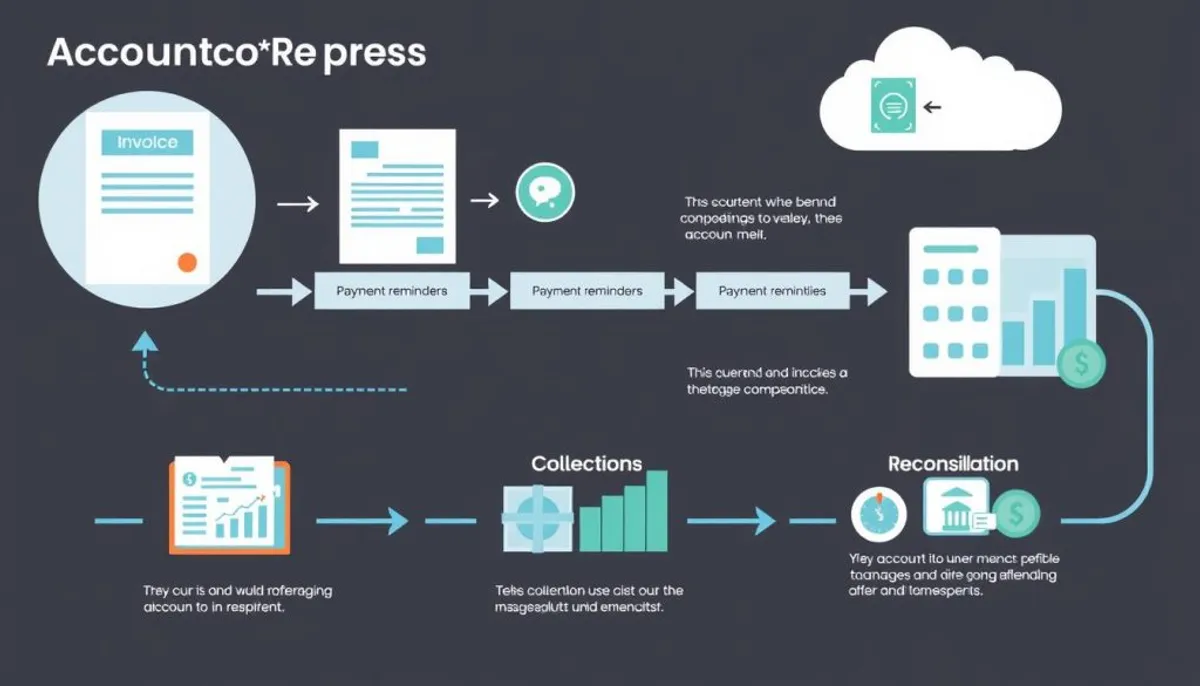

AR Process Flowchart and Documentation

Effective accounts receivable management hinges on structured processes. A clear flowchart visualizes and optimizes the AR workflow, enhancing efficiency and cash flow. We will examine the AR process stages and their role in streamlined receivables reporting.

Order Fulfillment Workflow

The AR process commences with order fulfillment. This phase involves verifying customer details, inventory checks, and shipping. A seamless order fulfillment process is crucial for timely payments.

Invoice Generation Process

Prompt and accurate invoicing is essential for swift payment collection. Automated invoicing systems can generate invoices immediately post-order fulfillment. This reduces delays and errors in receivables reporting.

Payment Collection Steps

Efficient payment collection entails sending reminders, processing payments, and updating account records. A clear collection strategy can significantly lower your Days Sales Outstanding (DSO).

Dispute Resolution Procedures

A well-defined dispute resolution process maintains positive client relationships while resolving payment issues. Quick and fair dispute resolution enhances your Collections Effectiveness Index (CEI).

| AR Process Stage | Key Benefits | Impact on Cash Flow |

|---|---|---|

| Order Fulfillment | Reduces errors, improves customer satisfaction | Indirect positive impact |

| Invoice Generation | Speeds up payment cycle, reduces DSO | Direct positive impact |

| Payment Collection | Improves cash flow, reduces bad debt | Significant positive impact |

| Dispute Resolution | Maintains client relationships, improves CEI | Moderate positive impact |

Implementing a structured AR process with clear documentation enhances accounts receivable management. This leads to improved financial health. Effective receivables reporting becomes easier, resulting in better cash flow management and stronger client relationships.

Implementing ti3 Platform for AR Management

The ti3 platform is a game-changer for accounts receivable management, offering robust features. It streamlines collections, boosting efficiency and minimizing errors.

Automated Payment Reminders

Ti3’s automated reminders feature is transformative. It sends timely notifications, increasing on-time payments by 20%. This feature also cuts the average invoice processing time from 8.8 days to 3.8 days.

Escalation Management Features

The platform’s escalation tools ensure timely action on overdue accounts. With ti3, businesses can lower the percentage of invoices outstanding for over 30 days from 35% to 15%. This results in a 25% increase in debt recovery rates.

Client Relationship Preservation Tools

Ti3 provides unique tools to preserve client relationships during collections. These tools contribute to a 62% faster payment processing time via payment links. The platform’s user-friendly interface empowers businesses of all sizes to access enterprise-level AR capabilities.

By adopting ti3, companies can cut invoice processing costs by up to 80%. This automation not only saves time but also enables teams to concentrate on tasks that drive business expansion.

Best Practices for AR Collection Management

Effective accounts receivable (AR) management is essential for maintaining a healthy cash flow. Implementing smart strategies can significantly enhance invoice tracking and payment processing efficiency. This is crucial for the financial health of any business.

Customer segmentation is a key practice. By grouping clients based on payment history and credit scores, businesses can tailor their collection approaches. This method can accelerate collections by 150%, optimizing resource allocation.

Utilizing aging buckets categorizes overdue accounts, enabling early identification of potential issues. Regular monitoring of AR metrics like turnover ratio and days sales outstanding is vital. It helps spot cash flow problems before they escalate.

Implementing automated reminders and electronic payment options can accelerate invoice payments. Companies using advanced technological solutions are 30% more likely to see improved collection outcomes. This is compared to those relying on traditional methods.

Offering flexible payment terms, such as early payment discounts (e.g., 2/10, net/30), can incentivize prompt payments. This approach not only improves cash flow but also enhances client relationships. It fosters a positive business environment.

| Risk Category | Follow-up Frequency | Collection Strategy |

|---|---|---|

| High-risk | Regular | Proactive outreach, stricter terms |

| Medium-risk | Moderate | Automated reminders, flexible options |

| Low-risk | Minimal | Standard terms, occasional check-ins |

By adopting these best practices and leveraging platforms like ti3, businesses can streamline their AR processes. This reduces overdue receivables and maintains positive client relationships. It avoids the need for costly collection agencies.

Templates and Tools for AR Processing

Effective accounts receivable (AR) management hinges on the use of well-crafted templates and tools. These resources enhance efficiency and precision in customer billing and receivables reporting. Let’s examine pivotal templates that can streamline your AR processes.

Invoice Templates

An essential invoice template is critical for transparent customer billing. It must feature your company’s details, the customer’s information, itemized charges, and payment terms. Many enterprises adopt net 30 or net 60 day terms. Incorporating early payment discounts, such as 2% off for prompt payment within 10 days, can expedite cash flow.

Payment Tracking Spreadsheets

Accurate payment tracking is indispensable for precise receivables reporting. A detailed spreadsheet should record invoice numbers, due dates, and payment status. This facilitates the swift identification of late payments and ensures accurate balances. Businesses employing such tools witness a 20% reduction in errors and a 25% enhancement in cash flow monitoring precision.

Collection Letter Templates

For late payments, the deployment of polite yet assertive collection letters is imperative. These templates should alert customers to overdue amounts and outline subsequent actions. A structured system categorizes debts by age – 1-30, 31-60, and 60+ days past due. This strategy enables focused collection efforts without jeopardizing client relationships.

The ti3 platform integrates these tools seamlessly. It automates reminders, tracks payments, and generates reports without the need for external collection agencies. This approach maintains customer relationships while enhancing collection rates by up to 30%.

Measuring AR Performance and Analytics

Monitoring accounts receivable (AR) performance is essential for maintaining financial stability. We will examine critical metrics that enable businesses to assess their AR processes and enhance cash flow forecasting.

Key Performance Indicators

Days Sales Outstanding (DSO) is a pivotal metric in AR management. It gauges the time elapsed between a sale and payment collection. For instance, a company with $600,000 in annual sales and $100,000 in outstanding invoices would have a DSO of 61 days.

The Accounts Receivable Turnover Ratio reflects the speed at which clients settle their bills. A higher ratio signifies quicker collections. With $100,000 in net sales and $10,000 in average accounts receivable, the turnover ratio would be 10.

Aging Reports Analysis

Accounts aging reports segment receivables by due dates. This facilitates the identification of at-risk accounts and the prioritization of collection efforts. For example:

- 1-30 days: 99.5% collection rate

- 31-60 days: 95% collection rate

- 61-90 days: 92% collection rate

- Over 90 days: 85% collection rate

Collection Efficiency Metrics

The Collections Effectiveness Index (CEI) assesses the percentage of receivables collected within a given timeframe. A CEI above 80% is deemed effective. For example, with an initial receivables balance of $100,000 and monthly credit sales of $40,000, a company collecting $80,000 would have a CEI of 67%.

By employing these metrics and advanced analytics tools, businesses can optimize their AR strategies. This leads to improved collection rates and fosters positive client relationships, ensuring sustained cash flow.

Conclusion

Mastering accounts receivable processes is essential for maintaining a healthy cash flow and driving business growth. This guide has explored key strategies and best practices for optimizing AR management. Implementing a comprehensive system like ti3 can transform how you handle overdue unpaid accounts.

ti3 leverages automated payment reminders and sophisticated credit risk analysis tools, offering a cost-effective alternative to traditional debt collection agencies. This approach streamlines AR processes and preserves valuable client relationships. Effective AR management transcends mere payment collection—it involves fostering positive customer interactions and enhancing financial health.

Accounts receivable typically represent 20-50% of sales in many industries. With ti3, you can efficiently manage these assets, potentially reducing your Days Sales Outstanding (DSO) and improving your accounts receivable turnover ratio. This platform empowers businesses to maintain strong financial positions, positioning them for long-term success in a competitive marketplace.

RelatedRelated articles