Effective cash flow management is paramount for a thriving business. Despite its importance, many enterprises face challenges with late payments. These delays can severely impede growth and introduce significant financial stress. This guide aims to equip you with the skills to craft compelling emails for requesting payment of outstanding balances, a critical component for maintaining financial health.

Late payments are a pervasive issue, affecting businesses of all sizes. Small enterprises, in particular, are often disproportionately impacted, with payments arriving an average of 8 days after the agreed-upon deadline. Such delays can have a profound effect on operational efficiency and growth potential. It is imperative to adopt a systematic approach to managing invoice follow-ups and overdue payment reminders to tackle this problem effectively.

Effective communication is paramount when dealing with unpaid invoices. Initiating the process promptly upon invoice issuance can help prevent many payment delays. This involves verifying contact details, offering clear payment instructions, and affirming payment terms. By establishing clear expectations and maintaining open communication channels, businesses can enhance their likelihood of receiving payments in a timely manner.

Key Takeaways

- Late payments affect 89% of business owners, hindering growth

- Small businesses face an average 8-day delay in receiving payments

- Early and clear communication is crucial for timely invoice settlement

- Structured follow-up processes can significantly improve payment collection

- Polite but firm reminders are effective in addressing outstanding balances

Understanding the Impact of Late Payments on Business Cash Flow

Late payments are a significant challenge for businesses, impacting their accounts receivable and overall financial health. The effects of delinquent accounts go beyond mere inconvenience, often causing severe disruptions in cash flow.

Statistics on Late Payment Effects

The prevalence of late payments is alarming. A staggering 87% of businesses report that their invoices are paid after the due date. This delay can increase Days Sales Outstanding (DSO) by up to 45%, impacting a company’s liquidity and growth potential.

| Impact | Statistic |

|---|---|

| Invoices Paid Late | 87% |

| DSO Increase | Up to 45% |

| Small Businesses Affected | 70% |

| Potential Revenue Loss | 30% |

Common Causes of Payment Delays

Payment delays often stem from various factors. These include clients’ cash flow issues, inefficient accounts payable processes, or intentional payment postponements. Recognizing these causes can help businesses tailor their late payment notice strategies effectively.

Financial Implications for Small Businesses

Small businesses bear the brunt of late payments. About 70% experience cash flow issues due to delayed payments, limiting their growth potential and operational capacity. Timely follow-ups on delinquent accounts can reduce the average collection period by 25%, highlighting the importance of proactive management in accounts receivable.

Best Practices for Professional Payment Request Communications

Creating effective payment reminder emails and collection emails is vital for maintaining a healthy cash flow. A well-structured approach can significantly enhance your chances of receiving timely payments.

Studies reveal that 59% of freelancers are owed $50,000 or more in late payments. This underscores the critical need for mastering professional payment request communications.

To optimize your payment collection process, consider these key strategies:

- Send payment reminder emails a few days before the due date

- Use contract templates for efficient and professional requests

- Implement a structured approach to escalate payment issues

- Automate reminder emails through a CRM system

Research indicates that 21% of invoices are paid after the first follow-up email, 20% after the second, and 32% after the third. This highlights the significance of persistent communication.

| Follow-up Email | Payment Rate |

|---|---|

| First | 21% |

| Second | 20% |

| Third | 32% |

Remember, a third of email recipients open messages based solely on the subject line. Craft compelling subject lines for your payment reminder emails to increase open rates and prompt action.

Essential Elements of an Email Requesting Payment Outstanding Balance

Creating an effective dunning letter necessitates meticulous attention to detail. A well-crafted invoice follow-up can notably enhance the likelihood of timely payment. Let’s dissect the pivotal components that underpin a successful payment request email.

Subject Line Optimization

Your subject line is paramount. It must be succinct and explicitly mention the invoice number and your enterprise’s name. For instance, “Invoice #1234 Payment Due – YourCompany”. This clarity enables recipients to swiftly comprehend the email’s intent.

Professional Greeting and Tone

Initiate with a courteous greeting and uphold a professional demeanor throughout. Be resolute about the payment necessity, yet eschew any aggressive tone. The objective is to secure payment while safeguarding the business relationship.

Payment Details and Documentation

Explicitly outline the amount owed and the original due date. Include the invoice and payment method links. A brief recap of services or products can also serve to clarify any potential confusion.

Clear Call to Action

Conclude your email with a precise request. For example, “Please process the payment of $X by [date].” Offer diverse payment avenues such as credit card, PayPal, or bank transfer to facilitate the client’s payment process.

By integrating these elements into your dunning letter, you forge a professional and potent invoice follow-up. This approach respects your client while firmly asserting your entitlement to prompt payment.

Timing Your Payment Reminder Communications

Optimal timing for payment reminder emails can significantly enhance the likelihood of timely payments. A well-executed strategy ensures a consistent cash flow for your enterprise. Let’s examine the ideal moments for these critical communications.

Initiate with a gentle reminder 3-5 days prior to the invoice’s due date. This early alert minimizes the chance of missed payments. On the due date, dispatch another reminder. This serves as a last call before late fees become applicable.

For overdue payments, adhere to the following schedule:

- 1-3 days after due date: Send a polite overdue reminder

- 5-7 days after due date: Send an early overdue reminder

- 14-21 days after due date: Send a persistent overdue reminder

- 30-45 days after due date: Send a final overdue reminder

Timing is not solely about when reminders are dispatched but also how they are delivered. Employ both email and SMS to boost visibility. Refrain from sending reminders on Fridays or weekends, as they are more likely to be ignored.

| Reminder Type | Timing | Tone |

|---|---|---|

| Pre-Due Date | 3-5 days before | Friendly |

| Due Date | On the day | Reminder |

| Early Overdue | 5-7 days after | Firm but polite |

| Final Notice | 30-45 days after | Urgent |

By adhering to this schedule and adjusting your tone appropriately, you can efficiently manage your accounts receivable. This approach also helps in preserving positive client relationships.

Pre-Due Date Reminder Strategies

Effective invoice follow-up begins before the due date. A proactive approach can significantly reduce late payments and enhance cash flow. Let’s explore key strategies to remind clients about upcoming payments.

Initial Invoice Delivery

Send your invoice promptly after completing work. Include clear payment terms, due date, and accepted payment methods. This sets the stage for timely payments and reduces confusion.

Courtesy Payment Reminders

Send a friendly payment reminder email 7-10 days after invoice delivery. This gentle nudge helps clients who might have overlooked the initial invoice. Keep the tone positive and include all relevant payment details.

Due Date Approaching Notices

As the due date nears, send a final reminder. This email should be sent 3-5 days before the deadline. Highlight the approaching due date and reiterate payment instructions. This strategy gives clients time to address any issues and helps prevent late payments.

Remember, the ideal payment reminder email is 50-125 words long. Emails within this range have a 50% response rate. Keep your messages clear, concise, and focused on encouraging prompt payment.

| Reminder Type | Timing | Purpose |

|---|---|---|

| Initial Invoice | Immediately after work completion | Set clear expectations |

| Courtesy Reminder | 7-10 days after invoice sent | Gentle follow-up |

| Due Date Notice | 3-5 days before deadline | Final pre-due date reminder |

Crafting Effective Follow-up Payment Requests

Composing a well-crafted collection email for an overdue payment can significantly enhance your chances of receiving funds. A follow-up email can increase dialogue restart by 22%, making it a crucial tool in the collection process.

Timing is paramount when crafting your follow-up. Send it within 3 days of the initial outreach to prevent a 45% chance of the recipient forgetting about the first email. Most recipients respond within 1 to 3 days, so plan your approach with precision.

Include specific details in your collection email. Mention the invoice number, amount due, and original due date. For overdue payments, state the number of days late and any applicable fees. Offer multiple payment options to accommodate customer preferences.

Keep your tone professional yet urgent. Polite emails with context have a 58% higher response rate. Include a clear deadline to increase responses by 34%. Use bullet points or lists for better readability – they receive a 35% higher read rate.

| Element | Impact |

|---|---|

| Clear deadline | 34% increase in response rates |

| Bullet points/lists | 35% higher read rate |

| Professional templates | 50% increase in engagement |

| Specific pain point in subject | 27% higher open rate |

Remember, sending more than three follow-ups may decrease positive responses by 29%. Strike a balance between persistence and respect for your client relationships.

Escalation Procedures for Overdue Payments

Businesses must have a well-defined plan for escalating payment requests when dealing with delinquent accounts. This strategy is crucial for maintaining cash flow and minimizing the risk of bad debt. Let’s examine effective strategies for managing overdue payments.

Executive Level Involvement

Involving executives can be a powerful tool in debt collection. When a payment is significantly overdue, reaching out from a higher level in your company can underscore the seriousness of the situation. This approach often prompts quicker responses and resolutions.

Legal Considerations

If friendly reminders don’t work, it may be time to consider legal options. Before taking this step, review your contract terms and local laws. Send a formal demand letter outlining the debt and potential legal consequences. This often motivates payment without court involvement.

Collection Agency Options

As a last resort, hiring a collection agency might be necessary. These professionals specialize in recovering delinquent accounts. While they charge a fee, their expertise can be valuable in recovering funds from persistent non-payers.

| Escalation Stage | Action | Typical Timeframe |

|---|---|---|

| Initial Follow-up | Friendly reminder email | 1-7 days past due |

| Second Notice | Phone call + email | 8-14 days past due |

| Executive Involvement | Email from company leadership | 15-30 days past due |

| Final Notice | Formal demand letter | 31-60 days past due |

| Legal Action | Consult with attorney | 61-90 days past due |

| Collection Agency | Transfer to professional collectors | 90+ days past due |

Remember, the goal is to recover payment while preserving business relationships when possible. Always maintain professionalism throughout the escalation process.

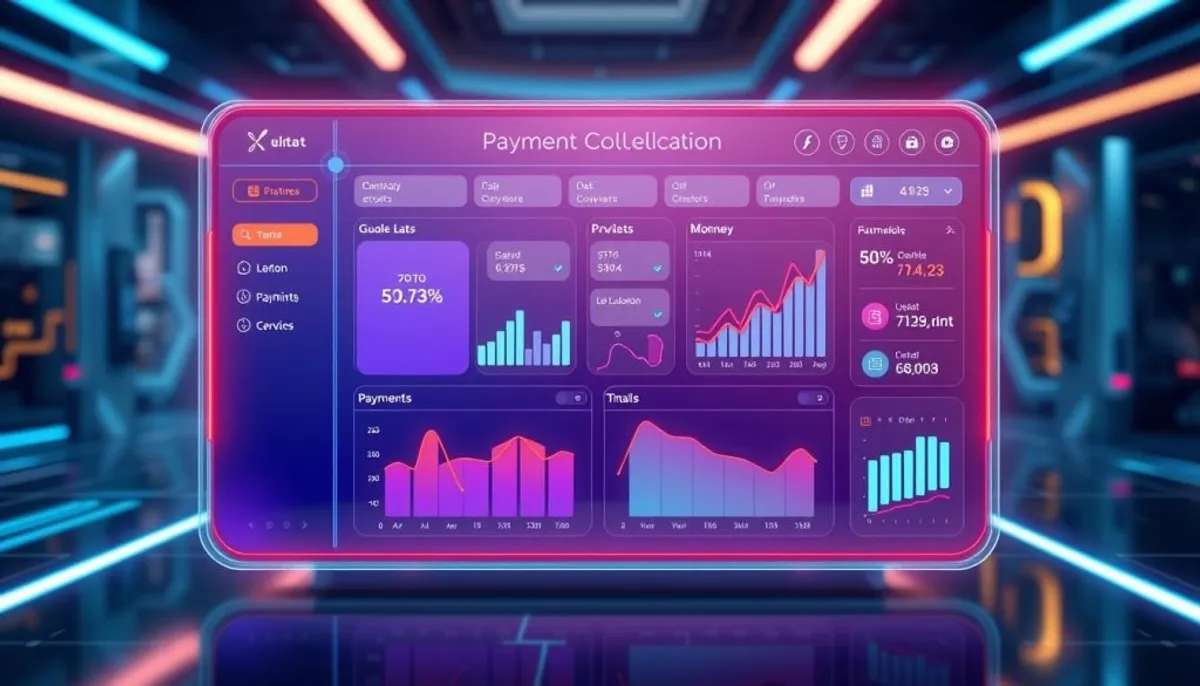

Using ti3 Platform for Automated Payment Collection

The ti3 platform is a game-changer for managing accounts receivable, introducing advanced payment automation. It addresses the critical issue of late payments, which hinders 89% of small and medium businesses’ growth.

Platform Features Overview

Ti3 boasts a suite of features aimed at simplifying the collection process:

- Automated weekly communications to debtors

- Customizable settlement options and payment plans

- Real-time monitoring of accounts

- Easy debtor addition and invoice management

Automation Benefits

The automation capabilities of ti3 offer substantial benefits:

- Reduces invoice processing time by 75%

- Cuts costs associated with manual processing by 80%

- Decreases average payment time from over 30 days to 14 days

- Eliminates the need for traditional debt collectors

Implementation Process

Integrating ti3 is remarkably simple:

- Choose a pricing plan (99 cents per invoice or $49 monthly subscription)

- Add debtors to the system

- Set up automated follow-ups

- Monitor progress through the platform’s dashboard

With ti3, businesses can efficiently manage overdue accounts, enhance cash flow, and preserve client relationships.

| Feature | Benefit |

|---|---|

| Automated Reminders | Reduces manual follow-up time |

| Customizable Payment Plans | Increases likelihood of debt recovery |

| Real-time Monitoring | Improves transparency and accountability |

| Multi-channel Communication | Enhances collection rates |

Payment Plan Negotiations and Solutions

Dealing with overdue invoices can be complex. It’s essential to explore flexible solutions when payments are severely delayed. Negotiating payment plans or settlements can help recover costs while preserving client relationships.

Proposing installment payments or partial settlements can be a viable strategy for managing invoices. These options enable clients to manage their finances while ensuring you receive fair compensation for services. Frame these proposals as gestures of goodwill, aiming for a swift resolution and mutual benefit.

Research indicates that companies employing effective negotiation tactics can recover up to 30% more in late payments. Using empathy can increase the client’s willingness to negotiate by 50%. Also, employing the right negotiation techniques can settle outstanding invoices 40% faster.

| Negotiation Strategy | Success Rate | Impact |

|---|---|---|

| Payment in full (top-down) | 70% | Faster resolution |

| Recurring payment plans | 80% | 20% reduction in payoff time |

| Down payment options | 85% | 15% decrease in outstanding balances |

When discussing payment plans, consider proposing higher monthly payments for quicker balance recovery. Down payments can also significantly reduce outstanding balances before setting up recurring payments. It’s crucial to document all agreed terms clearly and ensure both parties understand the conditions.

Maintaining Professional Relationships During Collection

Collecting payments can be a delicate task. It is crucial to uphold professional customer relations while effectively managing accounts receivable. Let’s explore some strategies to achieve this balance.

Communication Best Practices

Effective communication is paramount. Begin with a friendly tone in your initial collection letter. This method is effective, as 94% of recent debts can be collected promptly. Subsequent reminders, sent weekly, encourage payment without being overly aggressive.

Presenting various payment options or flexible plans can significantly improve customer response. Up to 70% of customers are more receptive to such reminders. This approach aids in maintaining professional relationships while ensuring timely payment.

Conflict Resolution Strategies

Conflicts can arise. Here are some strategies to address them:

- Listen actively to customer concerns

- Find solutions that work for both sides

- Document all communications

- Use multiple channels – phone, email, and letters

Preserving relationships can lead to future business opportunities. Companies see a 25% increase in collection rates when employing structured email templates. This method enhances professionalism and boosts payment success rates.

| Strategy | Impact |

|---|---|

| Friendly reminders before due date | 50% increase in invoices paid within 14 days |

| Regular communication | 60% higher success rate in debt collection |

| Offering payment options | 70% better customer response rate |

Legal and Ethical Considerations in Payment Collection

Debt collection is a complex field, requiring businesses to navigate legal and ethical landscapes. It’s essential to balance the need to recover payments with the duty to treat debtors with fairness and respect. Grasping the legal framework of debt collection is vital for compliance and safeguarding your company’s reputation.

The Fair Debt Collection Practices Act (FDCPA) outlines strict guidelines for debt collection. It prohibits tactics like harassment, false statements, and unfair practices. Debt collectors must provide accurate debt information and respect debtor rights. Breaching these rules can lead to severe legal repercussions.

Utilizing certified mail for collection letters ensures documented proof of delivery. This is crucial if legal action is required. It’s imperative to follow up if there’s no response within the stipulated time frame. A systematic approach to payment requests can boost timely payments by up to 30%.

Employing a professional and polite tone in all interactions is both ethical and effective. Aggressive methods can harm your company’s reputation and drive away customers. Research indicates that a courteous demeanor is more likely to elicit voluntary payment and cooperation.

| Ethical Consideration | Impact |

|---|---|

| Professional tone in communications | Increased likelihood of cooperation and payment |

| Aggressive tactics | Damage to company reputation and customer relationships |

| Accurate debt information | Compliance with FDCPA and reduced legal risks |

| Respect for debtor’s rights | Improved debtor cooperation and legal compliance |

By following legal guidelines and ethical standards, businesses can manage debt collection effectively. This approach not only supports financial stability but also upholds the company’s integrity in the market.

Conclusion

Managing outstanding payments is essential for maintaining healthy business cash flow. The statistics are alarming: SMBs face $825 billion in unpaid invoices as of 2023. This highlights the urgent need for effective strategies in requesting payment for outstanding balances. Implementing smart, automated collection processes can significantly reduce overdue payments, up to 20%. This demonstrates the substantial impact of technology in enhancing invoice follow-up efforts.

Creating polite yet firm communications is paramount. A respectful tone in your email can prompt quicker responses from clients. It’s important to be clear and direct to avoid confusion. Offering flexible payment arrangements can also enhance clients’ willingness to settle debts promptly. Achieving a balance between maintaining professional relationships and ensuring timely payments is crucial.

Tools like ti3 for automated payment collection can greatly simplify the process. Given that 99% of people check their email daily, this platform is an effective medium for sending overdue payment reminders. By integrating best practices in payment request communications with automated systems, businesses can enhance their payment recovery rates. This, in turn, reduces the negative impact of late payments on their operations.

RelatedRelated articles