In the realm of B2B commerce, the act of sending a collection email to customers is paramount for sustaining financial health. A meticulously composed email can serve as a bridge to reclaiming overdue payments, all while safeguarding the integrity of your customer relationships. Through the application of refined email marketing and customer engagement tactics, you can streamline your accounts receivable operations. This, in turn, reduces the likelihood of payment delays.

Effective collection emails are characterized by their simplicity, personalization, and directness. They must encapsulate critical information such as the original invoice, the amount owed, the due date, and available payment options. Achieving a harmonious blend of firmness and friendliness is pivotal for successful collection endeavors. By adopting a systematic approach to your collection email strategy, you can experiment with various templates. This experimentation will enhance your success rates over time.

Key Takeaways

- Well-crafted collection emails are essential for maintaining cash flow and customer relationships

- Include clear invoice details, payment instructions, and a personal touch in your emails

- Avoid aggressive or generic language in your collection communications

- Develop a tailored collection strategy based on payment methods and client profiles

- Use email marketing techniques to improve the effectiveness of your collection efforts

- Regularly analyze and refine your collection email approach for better results

Understanding the Importance of Professional Collection Communication

Professional collection communication is crucial for maintaining a healthy cash flow and preserving customer relationships. Effective debt recovery strategies, such as well-crafted payment reminders and invoice follow-ups, are key to a company’s financial health. These efforts significantly impact a company’s financial stability.

Impact on Business Cash Flow

Late payments can severely disrupt a business’s cash flow, impacting its financial stability. Studies indicate that 68% of companies facing cash flow problems receive over half their payments after the due date. Implementing effective collection strategies can help reduce average days sales outstanding (DSO) and improve overall financial health.

Maintaining Customer Relationships

While debt recovery is vital, preserving customer relationships is equally important. A friendly and professional tone in initial collection emails sets a positive stage for communication. Personalizing collection emails can greatly enhance their impact on clients, fostering transparency and collaboration.

Legal Compliance and Best Practices

Following legal compliance and best practices is essential when sending collection emails. This includes understanding state laws, respecting consumer rights, and providing clear instructions for payment. Utilizing certified mail for debt collection letters ensures documented proof of receipt and enhances communication efforts.

| Collection Communication Element | Impact |

|---|---|

| Professional Tone | Encourages cooperation and prompt payment |

| Clear Payment Instructions | Minimizes delays and confusion |

| Timely Reminders | Prevents overdue accounts and improves cash flow |

| Legal Compliance | Protects business interests and maintains reputation |

By implementing these strategies, businesses can enhance their debt recovery efforts, maintain positive customer relationships, and ensure compliance with legal requirements.

Essential Elements of an Effective Collection Email to Customer

Creating an effective collection email is vital for maintaining cash flow and customer relationships. With 87% of businesses facing late payments, mastering collection communication is essential.

Clear Invoice Details and Reference Numbers

Your collection email must include detailed invoice information and reference numbers. This clarity helps customers quickly identify the payment due. Include the original invoice date, amount, and any late fees. Clear account statements prevent confusion and expedite payments.

Payment Instructions and Methods

Offer clear, step-by-step payment instructions. Provide various payment methods to simplify bill settlement. This approach can significantly reduce time spent on accounts receivable tasks, which currently consumes over four hours weekly for 50% of businesses.

Professional Tone and Language

Keep your billing notifications professional. Avoid aggressive language to preserve customer relationships. Given that 93.8% of businesses use email for collections, finding the right balance between firmness and courtesy is critical.

Call-to-Action Elements

Include a clear call-to-action (CTA) in your overdue notices. Use a prominent “Pay Now” button or a link to your payment portal. Effective CTAs can significantly increase prompt payment rates, with 90% of businesses using proactive methods getting paid within a week.

| Element | Best Practice | Impact |

|---|---|---|

| Subject Line | 40-50 characters | Improves open rates |

| Preheader | 85-100 characters | Provides context |

| Greeting | Formal and personalized | Enhances professionalism |

| Grammar | Double-checked | Ensures credibility |

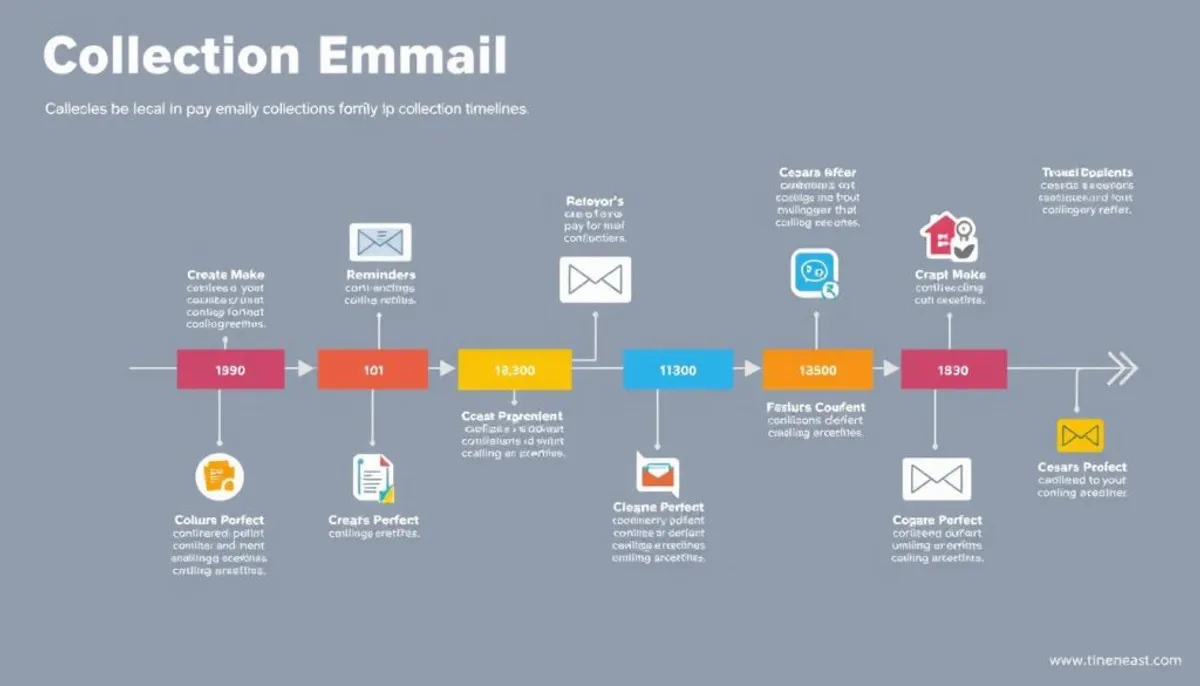

Creating a Strategic Collection Email Timeline

Developing a meticulous collection email timeline is essential for sustaining a robust cash flow. By carefully scheduling your dunning communications, you can elevate payment success rates and diminish instances of late payment. Let’s dissect an efficient framework for crafting your collection email schedule.

Initiate with an initial email that includes the original invoice. This establishes the groundwork for your payment protocol. If necessary, dispatch a courteous reminder a few days prior to the invoice’s due date. This preemptive strategy can avert missed payments and foster timely remittances.

For entities with a history of tardiness, adopt a more assertive approach:

- 1 week before due date: Send a reminder

- 1 week after due date: Follow up

- 2 weeks after due date: Send another reminder

Conversely, for consistent clients, a softer touch might be more appropriate:

- 1-3 weeks after due date: Send first follow-up

- 1-2 weeks later: Send subsequent reminders

Customize your timeline according to client profiles and payment histories. For subscription-based enterprises, address credit card failures expeditiously to avert service disruptions. By adopting a strategic collection email timeline, you can significantly reduce your Days Sales Outstanding and uphold favorable customer relationships.

Automated Solutions: Introducing ti3 Platform

In the realm of overdue accounts management, the ti3 platform stands out as a transformative SaaS platform. It addresses the hurdles of late payments directly, providing businesses with a robust tool to enhance their collection processes.

Features and Benefits

The ti3 platform is equipped with a range of features aimed at revolutionizing overdue accounts management. At its core, it offers automated reminders, ensuring timely follow-ups on unpaid invoices. This automation significantly reduces processing time by up to 80%, enabling businesses to concentrate on expansion rather than payment pursuit.

- Personalized payment reminders

- Analytics for priority account identification

- Automated workflows for different client groups

Integration Capabilities

Ti3 integrates seamlessly with existing accounting and financial tools, creating a unified platform for all collection activities. This integration capability minimizes errors by up to 66%, reducing the risk of costly manual data entry mistakes.

Cost-Effective Debt Recovery

The ti3 platform presents a cost-effective option compared to traditional debt collection agencies. By automating the collection process, businesses can substantially reduce invoice processing costs. Electronic invoices can cut costs by 60-80% by eliminating paper, printing, and mailing expenses. This efficient method not only saves financial resources but also aids in maintaining positive client relationships.

| Metric | Manual Process | With ti3 Platform |

|---|---|---|

| Average Payment Time | 30+ days | 14 days |

| Invoice Processing Cost | $12 per invoice | 60-80% reduction |

| Error Rate | 1% per 1,000 invoices | Up to 66% reduction |

With the ti3 platform, businesses can revolutionize their overdue accounts management, ensuring timely payments and enhanced cash flow. This SaaS solution empowers companies to manage their financial health effectively, allowing them to focus on business growth.

Personalizing Your Collection Communication

Effective debt collection relies heavily on personalized communication. Tailoring messages to specific customer profiles can significantly boost collection efforts. It also helps in maintaining positive client relationships.

Customer Segmentation Strategies

Client segmentation is crucial for personalized communication. Analyzing payment behaviors, demographics, and engagement history allows businesses to craft targeted messages. These messages resonate with each customer group.

Segmentation enables more precise targeting and relevant content delivery. This strategy leads to higher open rates, increased click-throughs, and better overall engagement.

Tailoring Messages by Payment History

Payment history provides valuable insights for crafting personalized collection emails. Customers with consistent on-time payments may respond well to friendly reminders. Those with a history of late payments might need more detailed explanations and payment options.

Cultural Considerations

When dealing with international clients, cultural sensitivity is paramount. Adjust your tone, language, and payment terms to align with local customs and expectations. This approach fosters understanding and increases the likelihood of timely payments.

| Personalization Strategy | Benefits |

|---|---|

| Segmentation by payment behavior | Targeted communication, improved response rates |

| Tailored payment options | Increased likelihood of collection, customer satisfaction |

| Cultural adaptation | Better international client relationships, faster resolutions |

Implementing these personalized communication strategies can significantly enhance collection processes. This leads to faster payments and stronger customer relationships.

Common Mistakes to Avoid in Collection Emails

Creating effective collection emails necessitates a focus on customer service and professional communication. Many businesses encounter communication errors that impede their debt recovery endeavors. It is essential to recognize and sidestep common pitfalls when crafting collection emails to customers.

One critical mistake is employing aggressive or impersonal language. Your emails should retain a civil tone, even when progress is slow. It is advisable to eschew generic phrases and opt for personalized addresses. Such practices can erode your reputation and customer relationships.

Inconsistent follow-up is another prevalent error. While it is vital to avoid harassment, neglecting collection efforts can be equally harmful. Achieving a balance between persistence and respect is crucial.

- Verify all debt information before sending notices

- Respect consumer rights throughout the collection process

- Avoid deceptive tactics or threats that violate collection laws

Personalization is paramount. Customize your messages according to the customer’s payment history and cultural background. This approach demonstrates respect and can enhance the success of your collection efforts.

By steering clear of these common pitfalls and emphasizing clear, professional communication, you can elevate your debt recovery success. This approach also fosters positive customer relationships.

Following Up: Escalation Strategies and Protocols

Effective follow-up is paramount in debt collection. A well-structured approach can significantly enhance your chances of recovering outstanding payments. It also helps in maintaining positive customer relationships.

Timing of Follow-up Messages

Timing is crucial when sending follow-up messages. Begin with gentle reminders shortly after the due date. If there’s no response, gradually increase the urgency of your communications. A typical timeline might look like this:

- 3 days after due date: Friendly reminder

- 7 days after due date: Second notice

- 14 days after due date: Final warning

- 30 days after due date: Consider escalation

Escalation Procedures

If initial attempts fail, it’s time to escalate. This might involve sending a formal demand letter or initiating direct communication for payment negotiation. Keep detailed records of all interactions to support potential legal action later.

When to Consider Alternative Solutions

After 90-120 days of unsuccessful internal efforts, consider engaging debt collection agencies. These professionals can often recover funds more effectively. As a last resort, consult legal counsel about pursuing legal action to recover the debt.

| Time Frame | Action | Next Steps |

|---|---|---|

| 0-30 days | Internal follow-ups | Send reminders, make phone calls |

| 31-90 days | Escalated internal efforts | Formal demand letter, negotiate payment plans |

| 91+ days | External intervention | Engage collection agency, consider legal action |

Measuring Collection Email Success

Tracking key metrics is crucial for evaluating the effectiveness of your collection email strategy. By monitoring these indicators, you can refine your approach and boost payment recovery rates.

One essential metric to watch is the open rate, which measures the percentage of emails opened by recipients. A high open rate suggests your subject lines are compelling. The click-through rate (CTR) reveals how many recipients engaged with your email content, indicating its relevance and appeal.

To gauge the impact on your business, focus on payment recovery rates and cash flow improvement. These metrics directly reflect the success of your collection efforts. Customer retention metrics are equally important, as they help ensure your collection strategy isn’t damaging long-term relationships.

| Metric | Description | Target |

|---|---|---|

| Open Rate | Percentage of emails opened | >20% |

| Click-through Rate | Percentage of recipients who clicked links | >3% |

| Payment Recovery Rate | Percentage of debts recovered | >50% |

| Cash Flow Improvement | Increase in available cash | >10% |

| Customer Retention | Percentage of customers retained | >90% |

Regularly reviewing these metrics will help you identify areas for improvement in your collection strategy and overall accounts receivable management. Remember to conduct A/B testing on your email content and timing to optimize results and boost your payment recovery rates.

Conclusion

Effective collection strategies are crucial for businesses to maintain a healthy cash flow and optimize accounts receivable. Implementing a strategic approach to collections enables companies to recover funds while preserving valuable customer relationships. The ti3 platform offers automation tools that streamline the collection process, allowing businesses to focus on customer relationship management.

Professional communication is key in collection efforts. Clear, concise emails with well-structured conclusions can significantly improve response rates. Statistics show that nearly 75% of business emails need better-aligned conclusions to achieve their strategic goals. By crafting thoughtful closings and using visual techniques like separate paragraphs, businesses can enhance reader engagement and elicit desired outcomes.

Remember, customer satisfaction should remain a priority even during collections. Offering solutions like discounts on future purchases for past inconveniences can help maintain goodwill. Timely responses and consistent information across all channels are crucial in preventing customer frustration. By continuously refining collection strategies based on performance metrics and customer feedback, businesses can ensure long-term sustainability and loyalty while effectively managing their accounts receivable.

RelatedRelated articles